With continued USD weakens, USDCNY dipped to the 6.75 level this morning, i.e. back to the level seen in October. The PBoC set the USDCNY fixing rate at 6.7451, the lowest in nine months. Chinese authorities are again in control of their currency.

On the one hand, capital outflows have been easing due to administrative measures, and China has increased its holdings of US Treasuries for the fourth consecutive month, according to recent TIS data.

On the other hand, the market has gradually turned around their expectations and believes that the CNY weakness, if there is any, will be moderate. Of course, the market only has a very short memory, which means that it could easily forget what it had believed in the past.

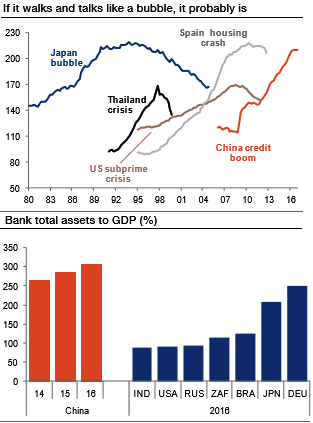

China is a source of angst for global investors with non-financial corporate debt at 166% of GDP compared with 97% a decade ago (refer above chart).

The bursting of a debt bubble in China would have far-reaching negative implications for emerging markets either via the risk sentiment channel or through commodity prices, global growth, and the global supply chain.

History tells us that credit booms lead to bubbles and to eventual crises. In China’s case, the risks are compounded by the large size of the banking system relative to GDP (refer above chart).

It is unclear if, or when, the bubble will burst in China, but it is the major medium-term risk factor for the entire EM currency complex.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025