Pick up relative value in conditional spreads, the conditional long/short vanilla spreads provide another avenue to explore when looking to fade vol risk premia. The idea is to structure zero-cost (or even premium negative) spreads of out-of-the-money vanilla options between two well-correlated pairs sharing a common pivot currency.

Opportunities arise when vols and skews in one pair diverge markedly from the other pair. Unsurprisingly, this is currently the case for MXNJPY vs other high beta JPY.

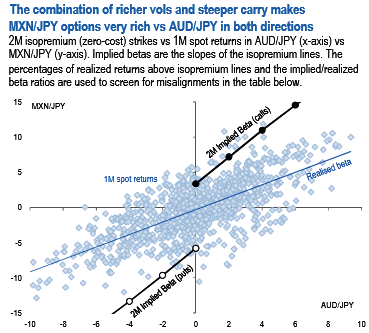

The above chart illustrates as to how the blow up in 2M MXNJPY vols and skews relative to AUDJPY is pushing the lines of isopremium strikes away from the cloud of realized spot returns. According to this picture, MXNJPY calls can be sold to fund AUDJPY calls, and as long as the implicit long AUDMXN stance isn’t upset in a dramatic fashion, the position should pick up positive theta.

Table 2 screens from a large universe of USD, EUR, JPY, GBP and AUD pairs to identify other such opportunities, applying filters on 1) 1yr realised R-Squares between 1M spot returns > 50%, 2) % of spot returns above isopremium line either > 30% or < 70%, and 3) log(Impl/Realised Beta ratio) > 0.25.

We also highlight the combinations that result in implicit cross pair stances that are consistent with our macro bias. The table ranks the combinations according to how far the % above isopremium is from the 50% mid-mark. It suggests that a vol carry efficient way to engineer a long USDCAD position is through a JPY pivot, by buying CADJPY puts funded by selling USDJPY puts.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields