The Australian federal government’s mid-year fiscal update is expected to show a deteriorating deficit as broad economic weakness offsets commodity price gains. Markets will be watching for any rating agency reactions. The Aussie crosses remain edgy, especially pairs like AUDNZD, AUDJPY well below fair value estimates implied by interest rates, commodity prices, and risk sentiment. However, Australia’s AAA downgrade risk is to be acknowledged, any such action likely to delay any return towards fair value during the next few month.

It seems rational that antipodeans currency crosses as “high yielding” avenues that suffer more as a result of the USD strength than most other G10 currencies.

From that point of view, it seems illogical that the yen is also suffering disproportionately. It seems that the new BoJ strategy that was only received moderately positively before the election, is now perceived to be much stronger in the form of Fed’s delivery of rate hike.

The fact that the BoJ is fixing long-term JGB yields seems a much more important measure if US yields are rocketing as a result of the new Fed view.

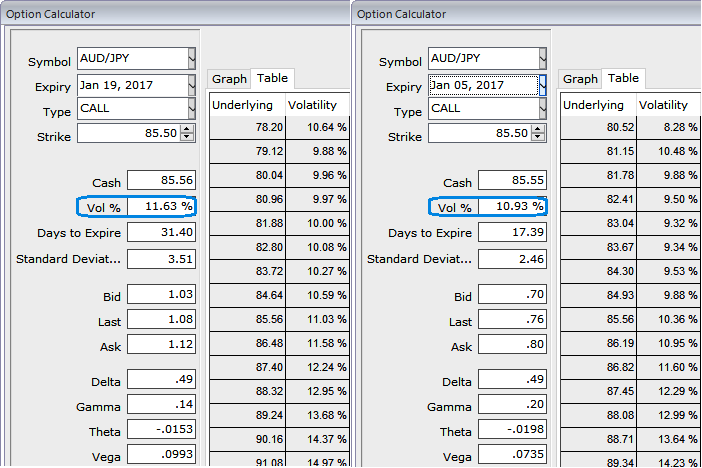

BoJ’s monetary is policy is scheduled for tomorrow, for this week, we think the pairs such as AUDJPY are blowing IVs crazily in OTC FX space that pops up with rising IVs above 10.93% for 2 week expiries and 11.63% for 1m tenors having significance in economic drivers that propels this currency pair to anywhere.

We retain our outlook for the BoJ to stand pat until at least mid-2017 when we expect the effects of fiscal stimulus to start fading. Next week’s focus will likely be on the post-MPM press conference and any comments BoJ Governor Kuroda may have about how yield curve control will be implemented amid rising yields

We think the same HY IVs with longer tenors are conducive and justifiable for option holders as there are series of considerable economic events lined up going forward.

Well, in order to arrest this upside risk that is lingering in intermediate trend and prevailing declining trend, we recommend diagonal option strap strategy that favors underlying spot’s upside bias in long run and mitigates bearish risks in short term.

So, we recommend building the FX portfolio exposed to this pair with longs positions in 2 lots of 1M ATM 0.51 delta calls and 1 lot of ATM -0.49 delta puts of 2w expiries.

Since, the slumps are likely in near term and upswings in near term seem to be dubious as per the signals generated by technicals as well as from IV skews, AUDJPY option straps strategy should take care of both upswings and downswings simultaneously, even if BoJ surprises with the forecasters and the strategy is likely to derive handsome returns on the upside and certain yields regardless of swings on either side but with more potential on upside.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated