Despite the prospects for better global growth next year, AUD is likely to underperform G10 peers due to an activist central bank in 2020. The RBA is expected to cut rates to 0.25% and to begin a QE program by 4Q 2020.

The RBA’s first foray into unconventional monetary policy in 2020 should be a unique differentiator for the currency when most other large central banks are either on hold (ECB), still easing but a long way from the ELB (Fed) or reaching the limits of existing balance sheet expansion policies (BoJ). In this context, we expect narrower interest rate spreads and RBA balance sheet expansion should push AUD lower over the course of next year.

However, the magnitude of the decline will be contained by an already cheap valuation and another year of relatively elevated commodity prices.

The projection for AUD is at USD0.66 by mid-2020, and at USD0.64 by end-2020. Our risk bias to AUDUSD in the next year is neutral given cheap valuation, largely neutral positioning and the fact that both domestic and US political risks are potential sources of asymmetric upside to the currency on anticipation of or delivery of a Feb cut. However, any abrupt rallies seem to be momentary and the major downtrend remains intact.

OTC Outlook of AUDUSD and Options Strategic Framework:

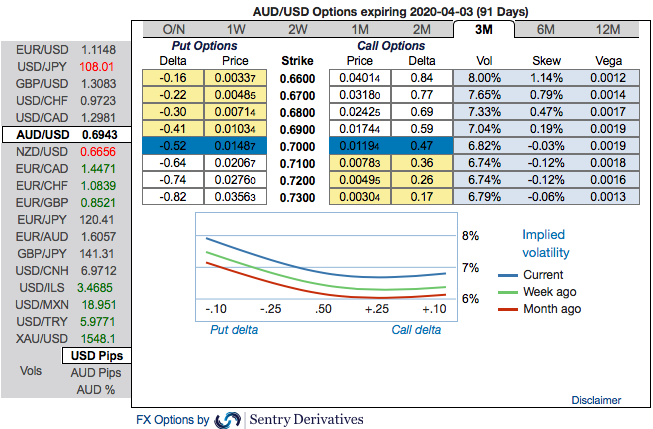

Can you buck the major trend of AUDUSD (refer 3rd exhibit). The positively skewed IVs of 3m tenors are also in line with the above predictions, they still signify the hedgers’ interests to bid OTM put strikes up to 0.66 levels (refer 1st exhibit).

Please also be noted that bearish neutral risk reversals (RRs) across all the longer tenors are also in sync with the bearish scenarios (refer 2nd exhibit for RR).

In a nutshell, AUD OTC hedgers’ sentiments substantiate that their risk mitigating activities for the further downside potential has been clear.

Accordingly, diagonal put spreads are advocated to mitigate the downside risks with a reduced cost of trading.

The combination of AUDUSD’s short-term potential to hit 0.70 and fails from there onwards amid lower IVs is luring for the OTM put options writers. While the medium-term perspective is attractive for bearish hedges via ITM puts.

The execution of options strategy: Short 2w (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options.

We keep reiterating that the deep in the money put option with a very strong delta will move in tandem with the underlying.

The rationale: Limiting downside though, we expect the RBA to hold steady into 2020 as it remains hopeful on Australia’s growth outlook and spec short A$ positioning is substantial. Any near-term probes above 0.6960 should attract sellers, with our mid-year-end target is still imminent at 0.6600 level which is sync with the IV skews. Courtesy: Sentry, JPM and Saxobank

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing

Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  RBA Deputy Governor Says November Inflation Slowdown Helpful but Still Above Target

RBA Deputy Governor Says November Inflation Slowdown Helpful but Still Above Target  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty