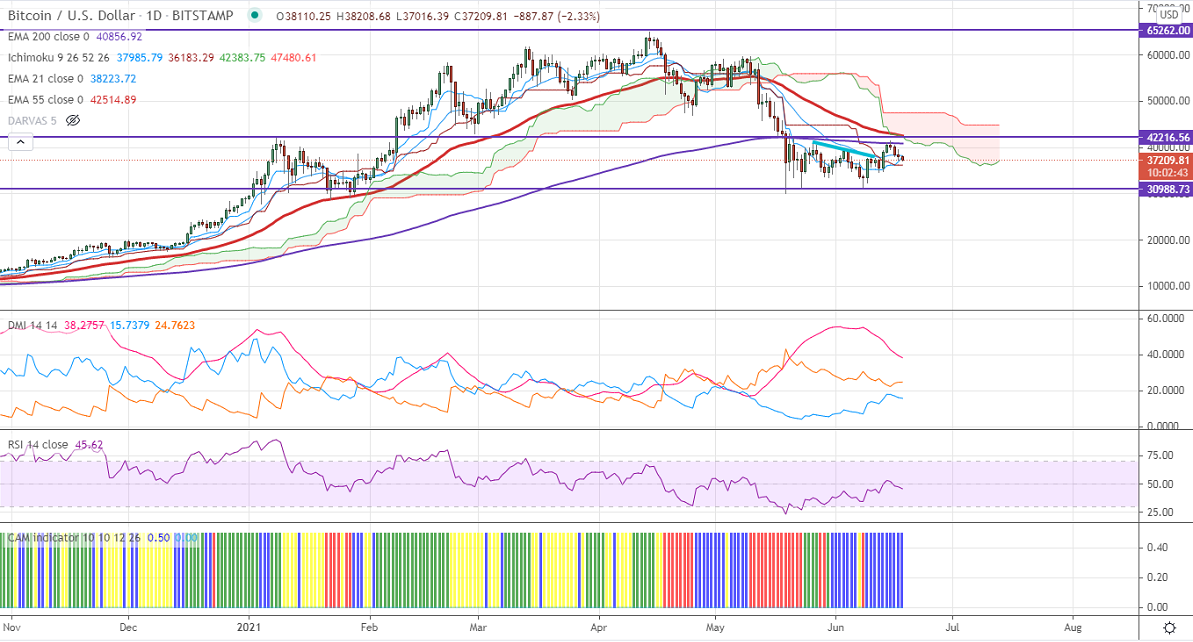

Ichimoku analysis (Daily chart)

Tenken-Sen- $36882

Kijun-Sen- $36183

BTCUSD has once again declined after a minor pullback above $40000.The overall trend is still bearish as long as resistance $47000 holds. The pair was one of the worst performers in the past month and lost more than 50% of its all-time high of $64985 due to negative news from China on crypto mining. It hits an intraday low of $37016 and is currently trading around $37154.

The near-term resistance is around $39553. Any indicative break above targets $41000/$42500/$43339/$45870/$47000. Short-term trend continuation above $47000.

The pair's minor support is around $36000. Any convincing break below will drag the pair down to $34800/$32550/$30000. Any close below $30000 will drag the pair down to $26800/$20000.

Indicator (Daily chart)

CAM Indicator – Slightly bullish

Directional movement index – Neutral

It is good to sell on rallies around $39000 with SL around $42500 for TP of $30000.