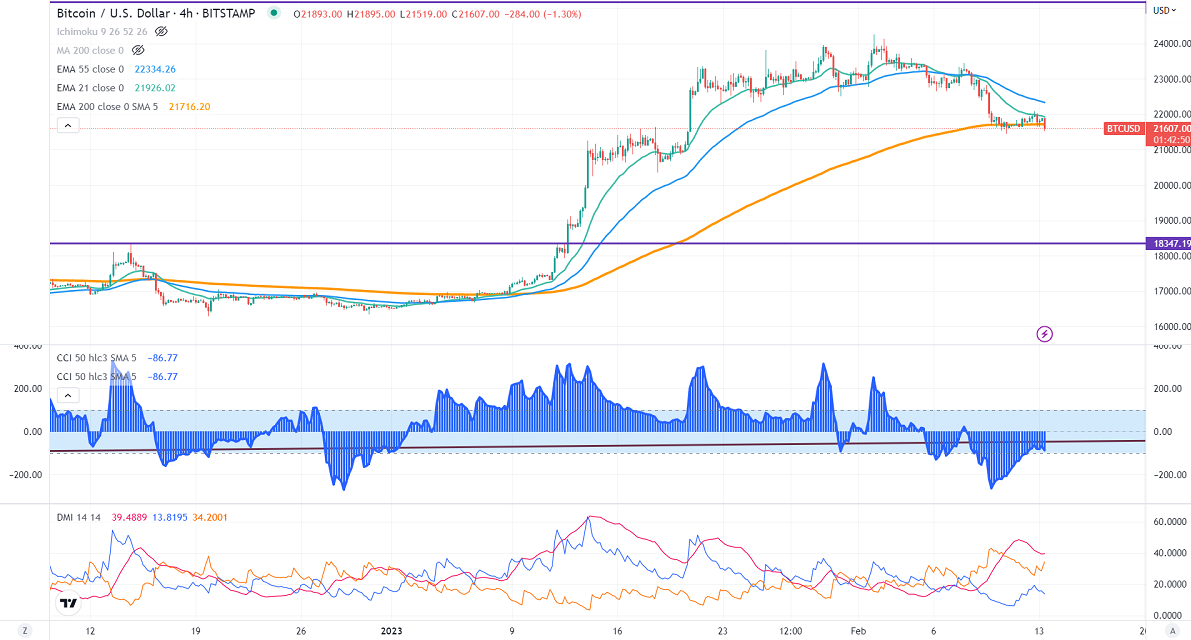

BTCUSD is trading lower for a second consecutive week on upbeat US jobs data. Hawkish comments from Fed members have increased the chance of further rate hikes by the Fed. It hits a low of $21467 and is currently trading around $21679.

Factors to watch for Bitcoin price action-

US markets -

NASDAQ (positive correlation with BTC)- Bearish (Negative for BTC). The index pared some of its gains after hitting a high of 12905. Any consecutive close above 13000 will push the NASDAQ to 13560.

US bond yields (Bearish)- Bullish for BTC. The US 10-year yield trades higher for the third consecutive week. Any break and close above 3.69% confirm minor bullishness. The yield spread between 10 and 2-year widened to -82 basis points from -79.40 bpbs.

Technicals-

Major support- $21500. Any break below will take you to the next level at $20000/$19570.

Bull case-

Primary supply zone -$22000. The breach above $22000 confirms minor bullishness. A jump to the next level of $23500/$25000 is possible.

Secondary barrier- $25000. A close above that barrier targets $30000/$32375/$36000.

It is good to sell on rallies around $23500-600 with SL around $25000 for TP of $15000.