Just glance through the implied volatilities of EURCHF ATM contracts from the above nutshell, IVs of this underlying pair of all expiries have still been the least among G10 currency segment despite this week’s G20 meeting and flurry of data announcements, such as, French, German & composite PMIs, German’s ZEW sentiment, current account balance which are significant. These lower volatile conditions are conducive for the option writers.

Let’s be noted that the skews of EURCHF have not been indicating any dramatic shoot up nor any slumps, but bearish neutral risk reversals indicate that this pair to have been hedged for the downside risks as it indicates puts have been relatively costlier.

The persistent euro strength should nudge EURCHF higher but significantly. As a result, chances of calls being priced exorbitantly. 1w IV skews have been well balanced on both OTM call and put strikes.

Please observe that the minor trend of this pair has been drifting in the tight range of 1.1750 and 1.1650 levels (refer rectangular area in daily technical chart). As a result, we recommend below option strategies using right options, thereby, one can benefit from certain returns.

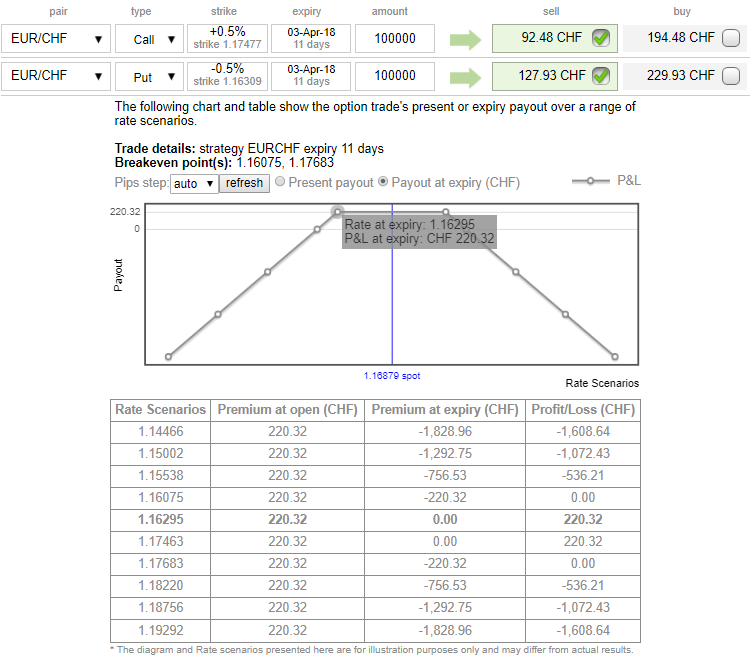

Naked Strangle Shorting:

Short 1w OTM put (1% strike difference referring lower cap) and short OTM call simultaneously of the same expiry (1% strike referring upper cap) (we reiterate, comparatively short term for maturity is desired).

Overview: The sideways trend but slightly bearish in short term.

Timeframe: 1-week

When you write an option, the seller wants IV to remain lower level or to shrink so the premium also fades away.

Hence, writing such calls seems smart choice in tepid IVs on speculative or trading grounds.

Considering above OTC market reasoning, amid prevailing bullish risks in the major trend we think downside risks in minor trend cannot be disregarded, as result we reckon deploying shorts in such exorbitant call options.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -9 levels (which is neutral), while hourly CHF spot index was at a tad below -1 (neutral) while articulating (at 11:22 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

These currency indices are conducive to the above-mentioned options strategy.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms