GBP fell further than expected in the aftermath of the UK vote to leave the EU and after the MPC eased policy at the start of August.

Since then, a bounce in economic indicators has been accompanied by a GBP bounce to levels where fresh shorts, vs EUR, are attractive.

The UK economy was slowing before the referendum and then additional uncertainty from the vote will only exacerbate that downtrend. The initial weakness of (mostly) survey data pointed to an economic hit but overstated the near-term magnitude.

The better recent data confirms the sky didn't fall, but a long period of corrosive economic uncertainty still lies ahead.

The current 67bp 2yr rate differential between the UK and euron reflects market expectations of ECB rates falling by around 15bp by the end of 2017, and a 68% probability that UK rates are unchanged at the end of next year.

From here, there’s a strong risk of rate spreads moving in the euro’s favour.

Temporary GBP bounce as investors reprice Brexit as a chronic, not acute shock, the bullish risk scenario we set out for GBP last month became the central scenario as growth was far more resilient than feared in the aftermath of the Brexit vote.

The result has been a squeeze on record short GBP positions and a consequent 4% rally in the GBP index. GBP has now recovered one-quarter of its immediate post-vote losses and one-fifth of its peaks or trough decline since last November (peak losses were 20% up to mid-August, reducing to 16% currently).

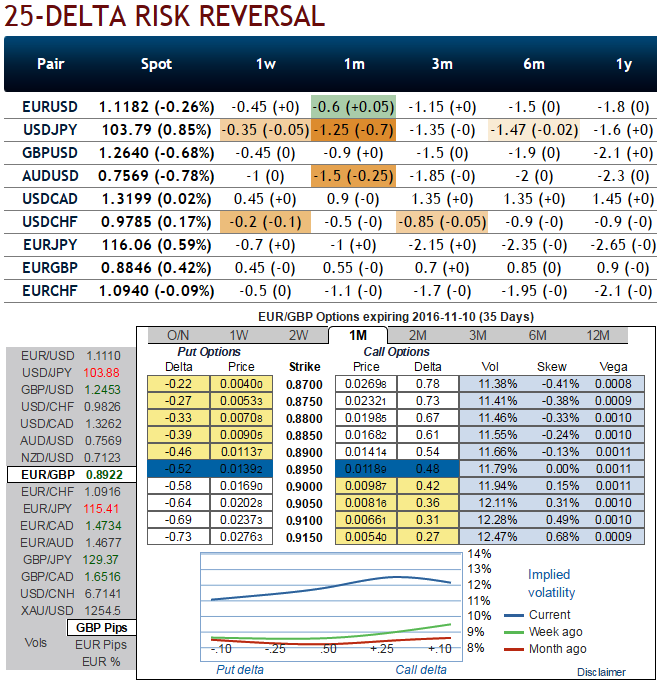

Please be noted that the OTC sentiments for this pair in short run turn towards bears favour as you can make out that the IV skews on ATM strikes of 1m tenors are equally balanced (i.e it may expire either ITM or OTM) and OTM strikes have positive skews.

To substantiate this sentiment, negative changes in hedging arrangements for next 1w expiry and no changes in long-term hedging upside risks. We foresee short-term price drops on the technical side as well while long-term uptrend remains intact so far.

Hence, bidding shorts eyeing on 1w negative risk reversals coupled with longs for upside risks as the 1m IV skews to favour call holders can establish an optimal hedging.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX