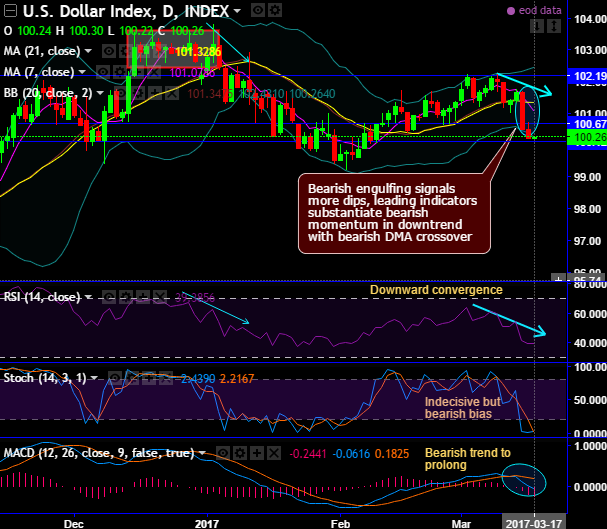

On the daily chart, the previous uptrend that was begun ever since the formation of dragonfly doji is now absolutely exhausted after the formation of bearish engulfing pattern causes slumps way below DMAs.

Bearish engulfing occurred at 100.53 level that signals more dips.

More bearish rout on cards after bearish DMA crossover (7DMA crosses below 21DMA), at this juncture both leading & lagging indicators signal bearish momentum. As a result, it has broken strong support of 100.67 levels.

Although the dollar is attempting gain traction for today, its strength is not signaled by the leading oscillators from the last two days against a basket of six other major currency peers, hence, we see no momentum in today’s attempts of bull swings.

Short term trend seems a bit weaker as you could probably make out from the US dollar index dipping from the stiff resistance of 102.19 levels to head towards next immediate strong supports at 99.84 levels, not far from the recent lows of 99.23 as well, its lowest level since February 02nd.

On a broader perspective, the major trend has been long lasting in range, upper range 103.82 and lower range at 92.30 levels, the major trend has been oscillating within this range since February 2015.

Well, both leading indicators (RSI & stochastic) on both dailies and monthly terms signal momentum in selling interests. While moving average and MACD on daily chart indicates the bearish trend in short term.

Although FED raised 25 bps in its funds rate and has hinted more hikes in 2017, Fed Officials see gradual rate hikes as upside risks debated.

While the dollar index (DXY) seems edgy at this juncture but senses strong support at 99.84 and 99.23 levels. To our surprise there seem to be no lingering doubts as to how reliable the news we are being told by the Trump camp going forward.

To arrest short-term downside risks we advocate initiating shorts in futures contracts with near month tenors. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.