The potential near-term NAFTA break-through is a potential catalyst for the recent retracement of this underperformance to run significantly further. Therefore we buy CADJPY (bought at 84.036, stop at 82.34) as a best risk-reward expression of CAD underperformance reversal for several reasons:

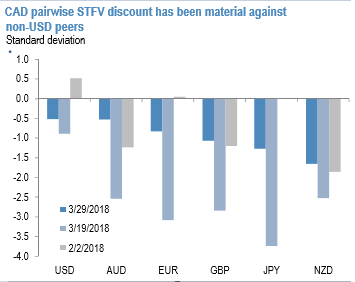

1) On a pairwise basis CAD retains one of the bigger discounts versus JPY (refer above chart);

2) We have flagged likely start of fiscal-year outflows challenging JPY in the near-term; and

3) Even as US-China trade tension has risen in the past week, JPY has become progressively less sensitive, perhaps in-part because of the shift in flow backdrop since the beginning of April.

Tactically, therefore, we are inclined to begin to test the water with renewed dollar shorts, but only very selectively where currencies enjoy an appropriate degree of idiosyncratic support. CAD is one such currency and we add a cautious low-cost USDCAD RKO this week to the long cash position we opened in CADJPY last week. The NAFTA break-through which seemed possible hasn’t yet materialized but investors remain confident that this is in the pipeline over the coming month or two. CAD is also being bolstered by a surge in domestic oil prices (up 50% in a month) as the WTI-WCS spread has atypically slumped in a rising WTI environment. The BoC next week could be the icing on the cake – we expect no change but also reckon this to be a closer call than the market gives credit for.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields