It is observed that the Japanese retail investors likely to surge foreign stock investments through investment trusts especially between May and July as we saw in the past two years. It is also expected that the USDJPY to rebound in 2Q a bit.

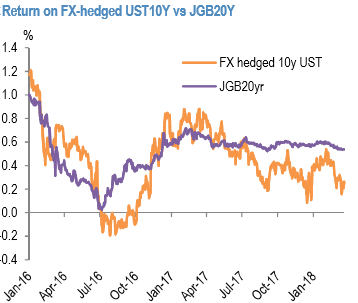

While the U.S. short-term interest rates have risen sharply, meaning that returns on FX-hedged U.S. bond investments are falling (refer 1st chart).

The US 10yr treasury yield rose from 2.77% to 2.84%, 2yr yields from 2.30% to 2.35%. Fed fund futures yields firmed to price the next rate hike in June as a 90% chance.

Given that U.S. long-term rates are relatively high and that the USDJPY rate is currently below the lower end of the CY’2017 range, life insurers could reduce the FX hedge ratio on U.S. bond holdings and a greater portion of their new overseas bond investing could be un-hedged. It would cause JPY sales.

Life insurers currently own a total of around ¥85 trillion in overseas bonds, and we estimate the ratio of FX-hedged overseas bonds to be around 70%.

Since reducing the ratio of FX-hedged bonds by 1% means selling over ¥800 billion worth of JPY, the impact cannot be ignored.

Separately, although returns on FX-hedged U.S. bond investments are diminishing, the returns on FX-hedged European bonds are relatively high (refer 2nd chart). While this would have no impact on the JPY market, we think FX hedged overseas bond investing by Japanese investors will probably shift away from U.S. bonds and toward European bonds.

Over the four months spanning October 2017 to January 2018, domestic investors were net sellers of U.S. bonds by ¥4.5 trillion and net buyers of European bonds by ¥2.8 trillion.

It seemed that in the recent times as if USDJPY was displaying exchange rate moves that correlated with the risk-on/-off news flow. But as soon as one takes a look at exchange rate moves of the second typical safe-haven currency, the Swiss franc, this does not really work. I fear the correlation structure of the exchange rates cannot be explained with simple, mono-causal stories such as risk-on/risk-off at present. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand