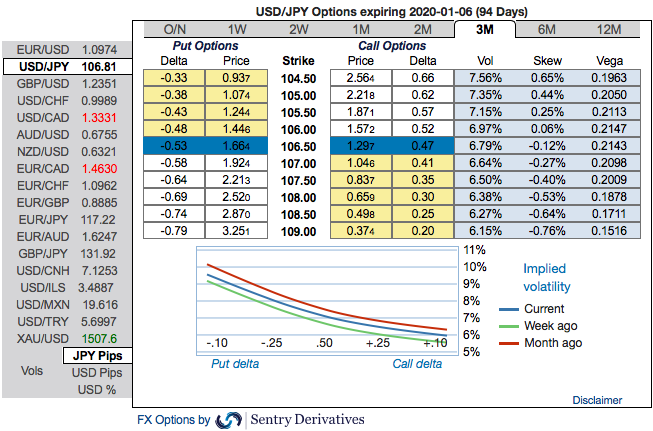

The positively skewed IVs of USDJPY of 3m tenors are signifying the hedging interests for the bearish risks. We see bids for OTM strikes up to 105.00 levels. This indicates hedgers’ interests in OTM put strikes, overall, put holders are on the upper hand (refer 1st nutshell).

While risk-reversals have been persistently bid through the back half of last year and most of this, so much so that RR/ATM ratios have now reached levels reminiscent of GFC era extremes (in favor of JPY calls, refer 2nd figure) despite nominal pricing of Yen options being orders-of- magnitude more benign today. It may be tempting to associate this apparent “distortion” with the risk-bearishness – and attendant hedging demand for Yen calls – brought about by the long-simmering US/China trade conflict. The reality is far more mundane however, and rooted in the currency hedging preferences of Japanese institutions and corporates as the Fed – BoJ policy rate gap widened over the past 12-18 months. Instead of incurring the steep negative carry of selling USDJPY forwards (to the tune of 250-300bp) to cover FX risks of USD receivables /US bond exposures, Yen buying flows have increasingly taken the form purchasing USD puts/JPY calls on risk-reversals that were judged to be relatively inexpensive vis-a-vis forwards.

At the same time, anecdotal accounts suggest that USDJPY ATM vols have come under severe pressure in recent months from (a) substantial quasi-programmatic option- selling flows from domestic asset managers for yield- enhancement in a low rates environment; and (b) structured vega supply from option-based USD-buying importer hedges via knock-out forwards and their variants; (c) without any serious demand offset from the global macro community’s directional option buying in the absence of sustained USDJPY spot trends. The net result has been a near-perfect storm for widening of riskie/ATM ratios over the past year.

However with the US – Japan rate gap shrinking by more than 100bp from its 2018 peak and USDJPY skews richening 0.6 - 0.8 %pts. across the curve over the same period, it is no longer clear that the forward points vs. risk- reversal relative value calculus that initially motivated the switch in hedging instruments is valid any longer.

Indeed, the simplest measure of relative attractiveness between the two from a cost-of-carry standpoint – the net static carry of a delta-hedged long risk-reversal position – has turned from materially positive in mid 2018 to decisively unfavourable return to forward based FX hedging and trigger a correction for riskies recently (refer 3rd figure), which in turn can inform a in skews to more normal levels.

Even if such vol surface normalization does not imminently materialize, we still see value in fading this extreme skew set-up by selling delta-hedged riskies (selling USD puts/JPY calls vs. buying USD calls/JPY puts) in sub-3M expiries as a theta positive way of hedging the risk of a limited US/China trade deal in October. Limiting such constructs to short dates ensures not only a faster pace of theta accretion, but also results in mark-to-market P/Ls being more sensitive to dGamma/dSpot (i.e. how realized vols behave as spot moves) as opposed to dVega/dSpot (the variation of implied vol with spot). The advantage of the latter is that we have greater confidence that Yen strength, if any, can remain a crawl but weakness can turn volatile (in a realized vol or gamma sense) if a limited trade deal is struck given the extreme bullish Yen speculative positioning at present (basis IMMs, 4th figure) and the likelihood of sudden liquidation in such an event. One could also consider Yen-crosses as short skew candidates given even more stretched short positioning in the likes of AUDJPY, but we prefer to stick to USDJPY given (a) a semblance of orderliness in USDJPY even in Yen rallies (i.e. in the direction of potential pain for a short riskie position) thanks to persistent FX-unhedged Japanese institutional outflows and importer bids for dollars; and (b) the long history of USDJPY skew-underperformance relative to cross-yen. Selling Yen riskies can be viewed as an asymmetric, carry- positive risk mitigator for macro portfolios positioned defensively like ours and therefore frontally exposed to constructive developments in the inherently unpredictable political process that is the trade negotiations. Courtesy: JPY

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One