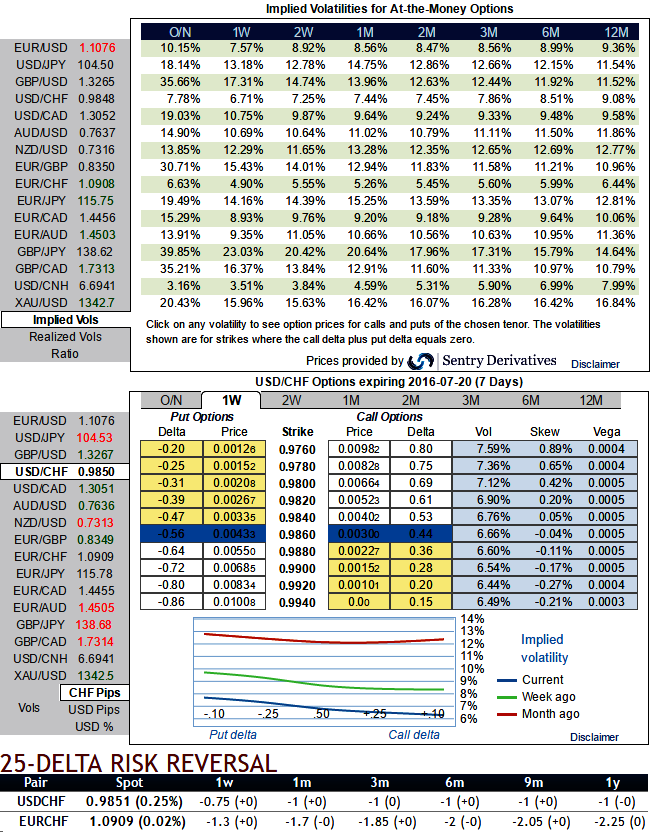

Let’s have a glance over OTC updates, hedging activities of Swiss franc crosses have been showing less interest in OTC markets.

1w ATM IVs have been lacklustre, slipped below 7% which is on lower side among G10 currency space.

While negative delta risk reversals signal hedgers are more concerned about downside risks of Swiss crosses, thereby they are willing to pay more for put options, which is the good news for OTM call writers as the underlying spot is likely to travel adverse to the call strikes. Hence, we would like to devise below option strategy so as to suit the puzzling swings of USDCHF.

SNB negative rate policy and asset program keep Swiss franc at stake, the Swiss National Bank has been maintaining its deposit interest rate unchanged at a record low of -0.75%, saying the franc remains significantly overvalued. The SNB has long since been concerned about the Swiss franc being in demand in connection with the Brexit outcome.

The ratio spread is a neutral strategy in options trading that involves buying a number of options and selling more options of the same underlying spot FX and tenors at a different exercise price.

Well, please be noted that it is the limited returns and unlimited risk options trading strategy that is taken if you think that the underlying spot FX will experience little volatility in the near term.

Overview: Sideways or slightly upwards.

The execution: It is a Combination of Bull Call Spread and Naked Calls. Buy a Call and sell more Calls at a higher strike price in the ratio of 1:2 or 1:3.

A Short time to expiration is preferred to take advantage of time decay in short positions and not to give stock time to move higher. The margin is required to take short call positions.

Breakeven Point: Short Strike Price + Difference in strike prices + Credit.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge