The market is currently seeing the likelihood of three Fed rate hikes until late 2017 as standing at 50% – the highest level since the FOMC meeting in March. At the time the market was still convinced that there would be a further two rate steps until end-2016. Now we know that there will be only one more this year. The same 2017 likelihood as in March, therefore, has a completely new quality.

It signals market expectations of a much faster Fed rate hike cycle. Hardly surprising as the 5Y×5Y inflation expectations (i.e. the market bet on average US inflation rates for the period of 2021/26) has reached new highs.

The FX Markets began pricing in owing to a Trump’s victory after the Republican candidate took the lead over the democrat. The U.S. dollar managed to bounce back vigorously after the US Election Day from the slumps of 101.190 to the current 106.140 levels during mid-European sessions.

The election of Donald Trump as the next US president saw the initial “risk-off” move properly trumped, as his acceptance speech was more conciliatory and the focus moved towards his fiscal policies. US equities, particularly the S&P500, flew back towards all-time highs, while the US yield curve steepened, led by 10-year yields racing up through 2%. This lent renewed support to the USD, especially versus G10.

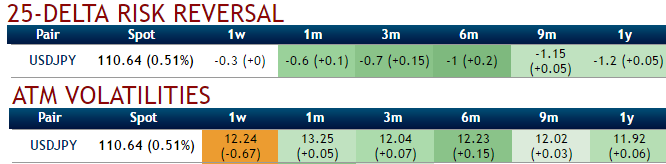

USDJPY risk-reversals: Hedgers of USDJPY began bidding OTM call strikes as you could see positive changes in risk-reversals. But these numbers in longer tenors are still very much a work in progress as far as vol selling opportunities go, with current levels (1M risk reversals at 12.8 vols & with reduced 1w vols for USD puts over USD calls) still removed from post-Brexit extremes (2.8), while 3m IV skews to substantiate bearish hedging offered by risk reversals. But short-term risks reversal bets signals the higher potential of USD.

If we do get close to those levels however, selling yen riskies should be highly attractive since the BoJ's yield curve control policy is proving more successful in capping JGB yields and suppressing yen vol than we had initially imagined, and a widening US-Japan yield gap as the Fed cycle resumes could conceivably even push USDJPY gradually higher towards the 105-107 area.

Needless to say, selling expensive yen calls should prove profitable amid such a mild updraft in USDJPY spot.

Hence, contemplating above risk reversal adjustments, we foresee the opportunities in writing overpriced ITM puts coupled with adding long positions in ATM delta puts long-term tenors.

As stated in our previous write up, we still maintain following option portfolios:

One can add 1m (1%) ITM shorts while going long in 3m ATM -0.49 delta puts or preferably longer tenors comparing to the short leg, use narrow expiries on the short side. This position would allow you with costless entry as you have narrowed tenors.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms