The FX Markets began pricing in owing to a Trump’s victory after the Republican candidate took the lead over the democrat. The U.S. dollar managed to bounce back vigorously after the US Election Day from the slumps of 101.190 to the current 106.140 levels during mid-European sessions.

The election of Donald Trump as the next US president saw the initial “risk-off” move properly trumped, as his acceptance speech was more conciliatory and the focus moved towards his fiscal policies. US equities, particularly the S&P500, flew back towards all-time highs, while the US yield curve steepened, led by 10-year yields racing up through 2%. This lent renewed support to the USD, especially versus G10.

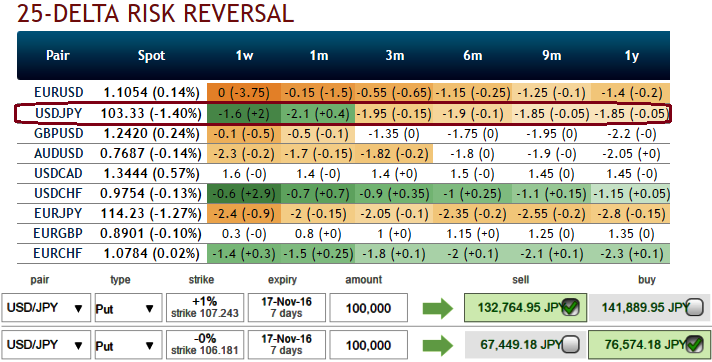

USDJPY risk-reversals: USDJPY risk-reversals are still very much a work in progress as far as vol selling opportunities go, with current levels (3M 25D risk reversals at 1.8 vols for USD puts over USD calls) still removed from post-Brexit extremes (2.8), 1m IV skews to substantiate this signal offered by risk reversals. But short-term risks reversal bets signals the higher potential of USD.

If we do get close to those levels however, selling yen riskies should be highly attractive since the BoJ's yield curve control policy is proving more successful in capping JGB yields and suppressing yen vol than we had initially imagined, and a widening US-Japan yield gap as the Fed cycle resumes could conceivably even push USDJPY gradually higher towards the 105-107 area.

Needless to say, selling expensive yen calls should prove profitable amid such a mild updraft in USDJPY spot.

Hence, contemplating above risk reversal adjustments, we foresee the opportunities in writing overpriced ITM puts coupled with adding long positions in ATM delta puts long-term tenors.

As shown in the diagram, one can add 2w (1%) ITM shorts while going long in ATM -0.49 delta puts with preferably longer tenors comparing to the short leg. Please be noted that the tenors chosen in the diagram are just for the demonstration purpose only, use narrow expiries on the short side.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms