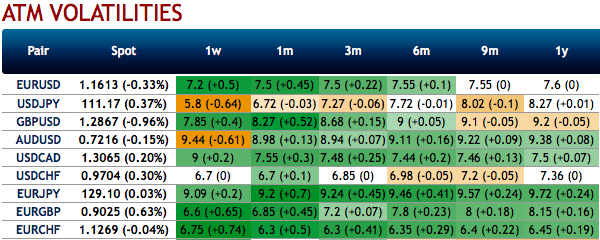

Before we jump to the strategic framework, please be noted implied volatilities (IVs) of 1m AUDUSD contracts flash second highest numbers among G10 space with mounting hedging sentiments for FX risks, whereas shrinking IVs in 1w tenors which is good for option writers.

Most importantly, please be noted that the positively skewed IVs of 2m tenors signify the hedgers’ interests to bid OTM put strikes upto 0.72 levels (above nutshell). While bearish delta risk reversal across all tenors also substantiate that the hedging activities for the downside risks.

Accordingly, we have advocated delta longs for long term on hedging grounds, more number of longs comprising of ITM instruments and capitalizing on prevailing rallies and shrinking IVs in 1w tenors, theta shorts in short-term to optimize the strategy (as shown below).

The execution of hedging strategy: Short 1w (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 1m (2%) ITM -0.79 delta put options. A move towards the ATM territory increases the Vega, Gamma and Delta which boosts premium.

Since the trend of this pair has been drifting in range as you can see the rectangular area on daily plotting of above technical charts and such price behaviour has been prolonged from last 4-6 weeks, theta shorts in OTM put option have gone worthless and the premiums received from this leg is sure profit.

We would like to uphold the same option strategy as stated above on hedging grounds. Thereby, deep in the money put option with a very strong delta will move in tandem with the underlying.

Both the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price dips and bid 2m risks reversals to optimally utilize delta long put options with a view of arresting bearish risks.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards -103 levels (which is bullish), while hourly USD spot index was at 159 (bullish) while articulating (at 08:30 GMT). For more details on the index, please refer below weblink:

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data