The BoC left interest rates unchanged last month but noted that the risks to inflation had tilted to the downside. This is likely to still be the case, but with some signs of stabilization in the economic data and the improvement in the oil price (WTI maintained above $50 levels from last two weeks), the likelihood of further rate cuts remains low at this stage.

Since BoC’s dovish shift in early September, we have flagged likely underperformance of CAD but thought that a break of USDCAD above the 1.33 top-end of the past half-year’s range was still more of a risk than a base-case scenario.

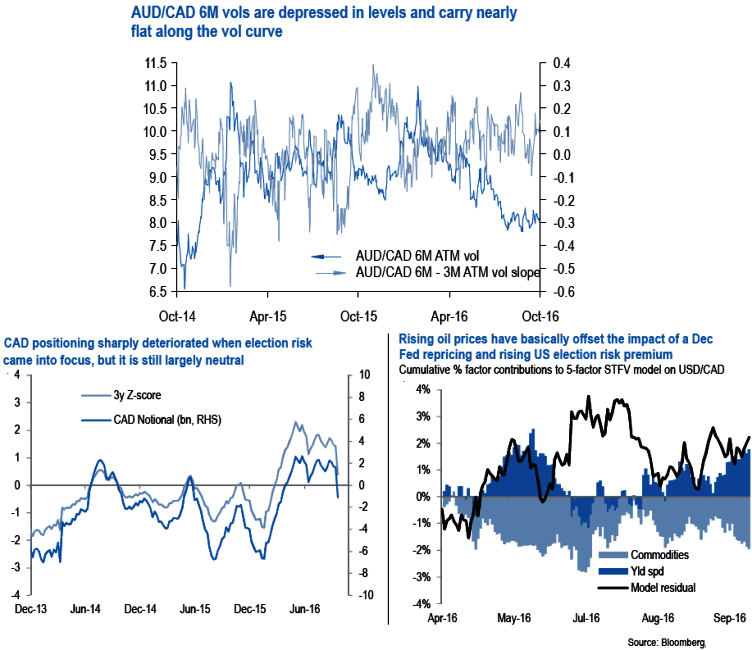

Following the BoC shift, and as US election risks came into better focus, positioning has built up against the CAD, and a discount has reopened.

AUDCAD 6M vols appear decent buys given their depressed levels (not far from 2014 lows) and the uber flatness of the 3M-6M vol curve.

Realized vols are not stellar however in a dollar-centric environment; hence theta bleed on vol longs is best avoided via forward volatility (FVA) structures.

Transaction costs on FVAs are prohibitive, though, hence vanilla expressions are the only viable option.

Gamma-neutral short 3M / long 6M calendar spreads to replicate FVAs is one possibility, but we reckon greater anti-risk returns can be generated out of AUDCAD by assuming short directional exposure to the cross via options in lieu of pure vol length given:

i) The spot is showing encouraging signs of beginning to mean-revert lower from the upper-end of a wide and fairly disciplined 2-yr trading range, with ample room to normalize (6-7% from current spot to range lows), and also screens 3% - 3.5% too expensive on cyclical fair value frameworks.

ii) AUDCAD spot and vol tend to be tightly correlated (inversely) during stress, but that spot-vol link is underpriced in risk-reversals that have compressed to near post-global financial crises tights.

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed