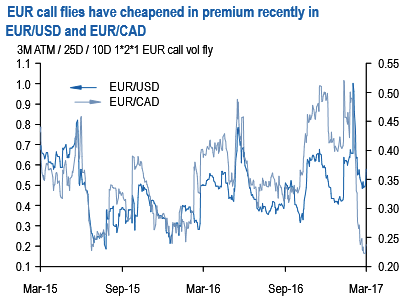

Along similar lines of EURUSD, we also like EUR call/CAD put flies.

The macro view on CAD is negative on a mix of BoC dovishness, sensitivity to NAFTA renegotiation talk which is likely to re-enter headlines over the next few weeks, and the potential for further near-term slippage in oil prices.

We introduce a Bank of Canada rate hike forecast for 3Q18 but would need to see a shift in tone to move it forward

Despite a strong run of Canadian data, the Bank of Canada has retained a dovish tone in its communications in recent months. This week continued that pattern, with Governor Poloz reiterating his belief that the Canadian output gap remains large, but January GDP subsequently surprised strongly to the upside. Our nowcaster now looks for 4.8% SAAR GDP growth in 1Q; we raise our forecast to a more cautious--but still robust--3.8%.

Hence, option pricing heavily favors EUR call/CAD put fly ownership, which are near 3y lows in premium (refer above chart).

2M 1.46 – 1.49 with 1.52 RKI –1.52 EUR call/CAD put flies indicatively cost at 35 bp EUR (spot ref. 1.4260, max payout ratio 5.8 times if RKI triggered, 11.4 times if not).

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic