Fundamental updates:

The Bank of Japan (BoJ) maintained its current quantitative and qualitative easing programme with yield curve control “aiming to achieve the price stability target of two pct.

BoJ maintains current QQE with yield curve control framework but pushes back timing of achieving the 2% price stability target The Bank of Japan (BoJ) maintained its current quantitative and qualitative easing programme with yield curve control “aiming to achieve the price stability target of two pct, as long as it is necessary to maintain that target in a stable manner” at its monetary policy meeting on 31 October to 1 November.

The BoJ kept its policy of applying a negative interest rate of -0.1% on part of the current account deposits held at the bank and maintained its long-term JGB yield (10yr JGB yield) target at 0.0%.

OTC Updates: Please be noted that the mounting hedging sentiments for bearish risks of EURJPY across different tenors.

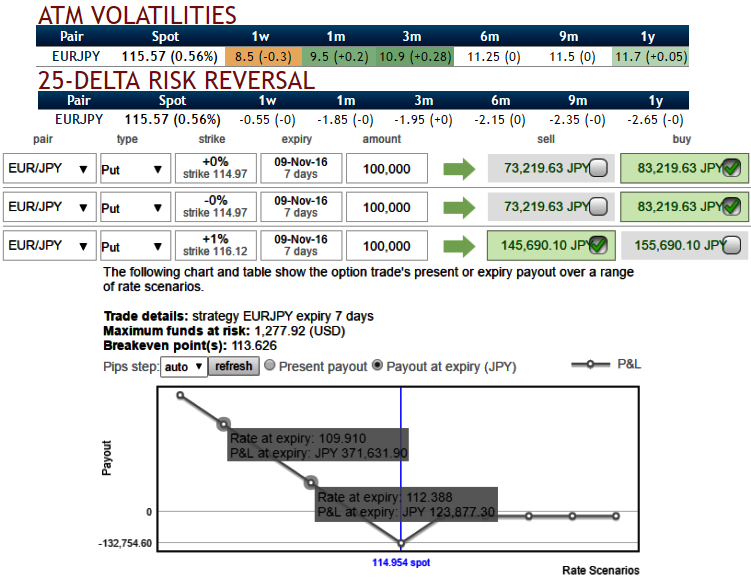

The implied volatilities of EURJPY ATM contracts are shrinking away in 1w tenors after BoJ’s monetary policy, crawling down at 8.5%, but rising above 9.5% and 10.9% in 1-3m tenors respectively. This volatility observation is absolutely suitable for tenor selection in diagonal put ratio backspread.

As you can see delta risk reversals are indicative of participants in this pair are more concerned about further slumps especially in next 1month’s timeframe. Rising negative flashes indicates active hedging sentiments for these downside risks.

Acknowledging the gradual decrease in the implied volatility of EURJPY but with higher negative risk reversals in long run is justifiable when you have to anticipate forwards rates and observe the spot curve of this pair (see IVs, RR nutshell, Sensitivities, and compare with spot prices).

The major trend is declining trend, from last two years or so the pair has consistently evidenced considerable price slumps from the last couple of months, and we could still foresee more downside potential ahead.

In option trading, the holders tend to perceive the put ratio backspread as a bear strategy, because it employs more numbers of long legs. However, it is, in fact, a volatility strategy.

Hedging Positioning:

“Short 1w (1%) ITM put option, go long in 1 lot of long in 2w ATM +0.49 delta put options and 1 lot of (1%) OTM -0.36 delta put of 1m expiry.”

The position is a spread with limited loss potential, but varying profit potential. The degree of profit relies on the strength and rapidity of price movement. The position uses long and short puts in a ratio, such as 2:1, to maximize returns.

Please be noted that the tenors and strikes chosen in the strategy is just for the demonstration purpose only.

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty