We believe that BoJ has shifted its monetary policy stance in last monetary policy meeting (MPM), however, any decisions by the central bank at the next MPM (including some “surprises” discussed above) would be unlikely to play a role of game changer, unless the bank (and the government) implements the regime shift in “helicopter money policy”.

As was seen in January when USDJPY rally ignited by the surprising BoJ decision to introduce NIRP lasted only for three days, given the current condition, where JPY’s fundamentals are solid (e.g. increased current account surplus).

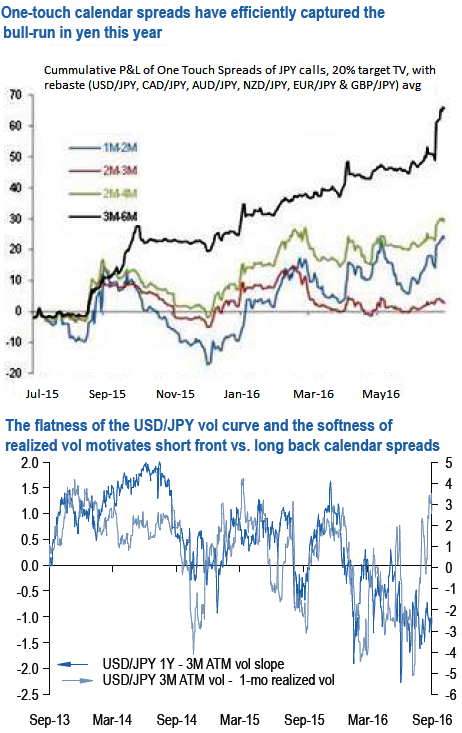

Elsewhere, on grounds that the vol curve is inverted in the 3M-1Y sector and that ex-BoJ day realized vols are soft compared to ATMs (below chart, 3M ATM 11.65 vs. ex-BoJ realized vol 10.5).

This class of trades has worked well for us this year given the persistent flatness of the yen curve, and we have often exploited the set up via one-touch calendar spread which is also a genuine directional alternative to straddle calendars in this instance.

The above chart explains that such structures have performed well in capturing the yen’s bull run this year, and function best on a basket of yen-crosses for short 3M vs. long 6M tenors.

Applied to USDJPY, this would suggest short 3M 94 vs. long 6M 94 one-touches that cost 13% to buy in equal USD notionals, and roll up to 25% in 3- months time should spot remain around current levels i.e. static carry gains of roughly 100% of the upfront premium.

The hope, of course, is to thread the needle by virtue of gentle yen appreciation over the next three months that stops short of breaching 95 – possibly as intervention concerns come to the forefront – and can lead to 2X-5X returns on upfront premium depending on terminal spot levels.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025