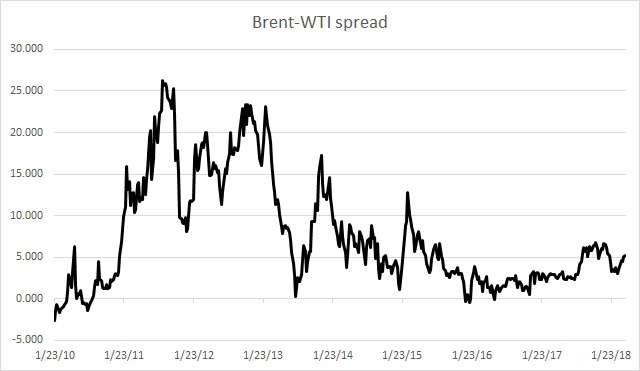

Brent-WTI spread is rising once more as clouds of Geopolitical uncertainty covers the Middle East and as U.S. production continues to rise. After reaching a bottom in late February around $3 per barrel, the Brent-WTI spread reached $5.15 per barrel this week, which is the highest level for the spread since January. It has been declining since December after reaching as high as $7 per barrel as U.S. exports increased, however, as it is becoming apparently clear the there is a supply/demand mismatch in North America, the spread has reversed course. We at FxWirePro expect the spread to test December high and move beyond. The current crisis over Syrian chemical attack has also been helping the Brent to gain ahead of the North American benchmark WTI.

Unless the U.S. exports can keep up the pace with the production, which has increased by more than 2 million barrels per day since bottoming in July 2016. The current production stands at 10.46 million barrels per day. The bottlenecks (due to lack of transport) also keeps the North American benchmark suppressed against Brent.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed