London’s financial industry from banks to hedge funds to insurers -- is pretty clear when it comes to the number one risk to financial stability: Brexit. U.K. political risk has jumped to the top of the chart in the Bank of England’s latest biannual survey, and almost every respondent who cited it explicitly referred to the European Union referendum.

Asked what issue is the hardest to manage, political risk also comes out on top, scoring more than twice as high as the second-ranked threat. The Sterling appreciated notably in the recent times. Anyone looking for a convincing reason behind this move would probably be dissatisfied.

We individually reckon that it is unconvincing and unsustainable as the reason behind it that is being cited was Prime Minister Theresa May’s assertion to British commerce that Great Britain would not leave the EU without a trade agreement or a transitional solution. In particular, as she made these comments hours before the move in the GBP exchange rates.

For now, more Brexit-related weakness and Fed hikes and estimates to attract shorts in GBPUSD during December and early 2017.

As stated in our recent post, we are sensing the copy-cat range process of the summer range we have been looking for in the medium term perspectives. This has actually become a range within that range, with 1.2300 – 1.2510 the inner range, while 1.2080 – 1.2675 is the current outer range. 1.28-1.31 is major resistance for us above there. The cross is the main driver at this stage. Long term, we see a greater risk of another downside test and only that should complete the prevailing bear cycle.

Hence, at spot ref: 1.2634, we recommend buying GBPUSD 3m risk reversal vanilla strikes of 1.28 and deep ITM 1.30.

The position is naturally long vega on the downside and short on the topside, fitting with the volatility market dynamics. Cable skew normalized too much Five weeks after the Brexit vote, the GBP volatility market normalized sharply.

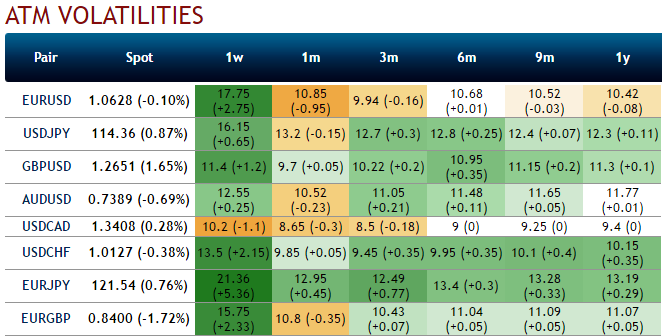

Alternatively, we buy 3m risk reversals again that favors bearish sentiments since the GBPUSD’s implied volatility is perceived to be rising among the major currency counterparts (but 1m ATM contracts shrinking below 10% in recent times, as a result, one can also think of writing expensive options.

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure