Bearish EURJPY Scenarios:

1) ECB goes all-in with rates cuts, tiering and QE.

2) Trump proceeds with tariffs on Euro car imports.

3) A no-deal Brexit.

4) The trade tensions between the US and China intensify and global investors’ risk aversion heightens significantly,

5) The unexpected monetary policy change by the BoJ

6) The US starts vehemently criticizing Japan’s trade surplus with the US.

Bullish EURJPY Scenarios:

1) Euro-area economy rebounds to a sustained 1.5%+ growth rate.

2) A US-China peace treaty on trade.

3) 3) A re-acceleration of CB demand for EUR.

4) The momentum in JPY selling flows related to outward portfolio investments and FDI strengthens.

EURJPY trend has been weaker in both minor and major trends amid some abrupt rallies. The European Central Bank (ECB) is scheduled for their monetary policy on 12th September, they showed readiness to cut its key rate in its recent monetary policy. So, there is no reason for the euro to appreciate considerably in the short run.

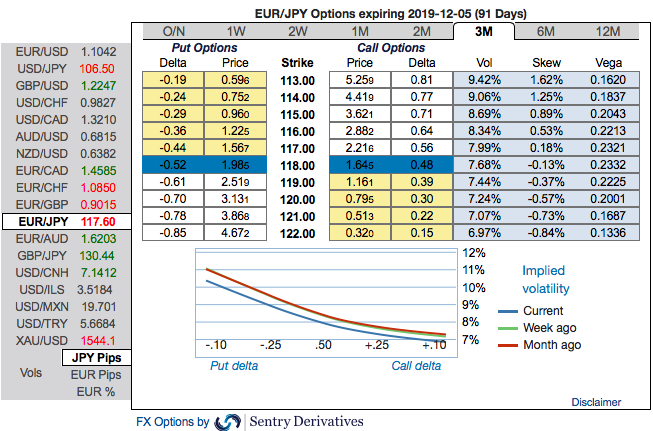

OTC outlook: Please be noted that the positively skewed IVs of 3m tenors that are also signifying the hedging interests for the bearish risks. The bids for OTM puts expect that the underlying spot FX likely to show further dips so that OTM instruments would expire in-the-money.

Most importantly, to substantiate the above indications, we could see some minor positive shifts in existing bearish risk reversal set-up of EURJPY that indicates the long-term hedging sentiments across all tenors are still substantiating bearish risks amid minor abrupt upswings in the short-term. Please be noted that 3m IVs are overall OTC barometer is noteworthy size in the forex options market that can stimulate the underlying forex spot rate.

Options Strategy: Contemplating the above factors, we’ve advocated buying 3m EURJPY (1%) ITM -0.79 delta puts for aggressive bears on hedging grounds as the mild abrupt upswings were contemplated earlier.

Short hedge: Alternatively, we advocated shorts in futures contracts of mid-month tenors with a view to arresting potential dips. since further price dips are foreseen we would like to uphold the same strategy by rolling over these contracts for September month deliveries. Source: Sentrix, JPM & Saxobank

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness