Bearish EURUSD Scenarios:

1) ECB tweaks tiering details.

2) Trump proceeds with tariffs on Euro car imports.

3) A no-deal Brexit.

4) The re-escalation of risk in Italian politics.

5) The US cyclical exceptionalism returns and extends. The global recession risks rise further and sharply.

6) Fed communication turns less dovish on inflation.

Bullish EURUSD Scenarios:

1) Trump sanctions unilateral FX intervention to weaken the US dollar. The US government unconventionally intervenes in the US macro policy.

2) A US-China peace treaty on trade, the conflict is eliminated and global growth rebounds vigorously.

3) Euro-area economy rebounds to a sustained 1.5%+ growth rate.

4) A re-acceleration of CB demand for EUR.

5) The Fed eases either pre-emptively ahead of formalization of the policy framework rethink, or because inflation fails to rebound.

The US Federal Reserve Open Market Committee (FOMC) begins its two-day policy meeting later today. A quarter-point reduction in interest rates is widely expected to be announced tomorrow, but prospects for more easing further out are less clear. We expect today’s US August industrial production report to show a 0.3%m/m headline increase, more than reversing the 0.2% fall in July.

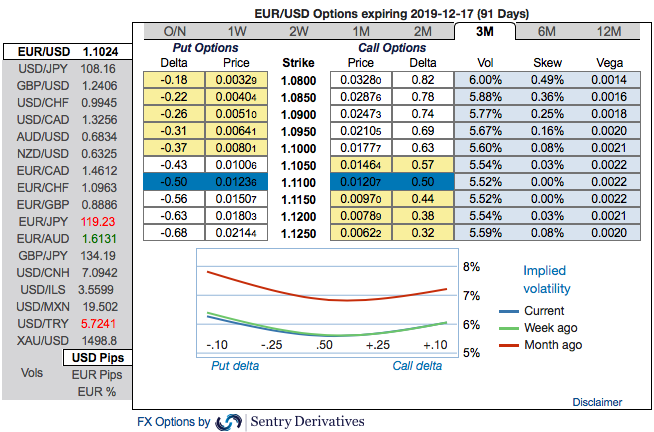

OTC Updates: While 3m skews are stretched on either side (equal interest in both OTM call and OTM puts), 3m positively skewed IVs have still been signaling downside risks and upside risks as well. Skews stretched towards OTM put strikes signifies hedgers interest in the further bearish risks in the major downtrend.

To substantiate these indications, bearish neutral RRs across all tenors, which is in line with the above-stated bearish scenarios. But one could observe the positive shift in shorter tenors.

All these indications coupled with the fundamental news and the underlying scenarios are attractively appealing ITM put holders. Contemplating all these factors, we advocate below options strategy.

EURUSD’s upswings are observed from the last couple of days ever since it has jumped from the lows of 1.0925 levels. However, the interim upswings unlikely to sustain in the long-run as it is struggling for the convincing buying momentum. So, we emphasized the bearish stance in the major trend in our technical section as well.

Hedging Strategies: Initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 3M tenors, write (1%) out of the money put option of 2w tenors.

While, the dubious bulls but with hedging grounds, can also deploy 3m 1% in the money puts with attractive delta. Thereby, in the money put option with a very strong delta will move in tandem with the underlying.

Alternatively, ahead of Fed monetary policy that is scheduled for tomorrow, shorting futures of mid-month tenors have been advocated with a view of arresting further potential slumps, we now wish to uphold the same strategy. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position. Courtesy: Sentrix, JPM & Saxobank

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis