Bearish EURGBP Scenarios:

1) ECB goes all-in with rates cuts, tiering and QE.

2) A no-deal Brexit.

3) Tories drop in the polls, Johnson loses a no-confidence vote and the subsequent general election.

4) Article 50 is eventually withdrawn.

Bullish EURGBP Scenarios:

1) Euro-area economy rebounds to a sustained 1.5%+ growth rate.

2) A reacceleration of CB demand for EUR.

3) The Tories enjoy a material opinion poll bounce under Johnson, increasing the odds on an early election and the removal of parliament’s blocking majority on a no-deal.

4) UK recession.

OTC Updates: Well, ahead of these events, let’s just quickly glance at OTC outlook before looking at the options strategies.

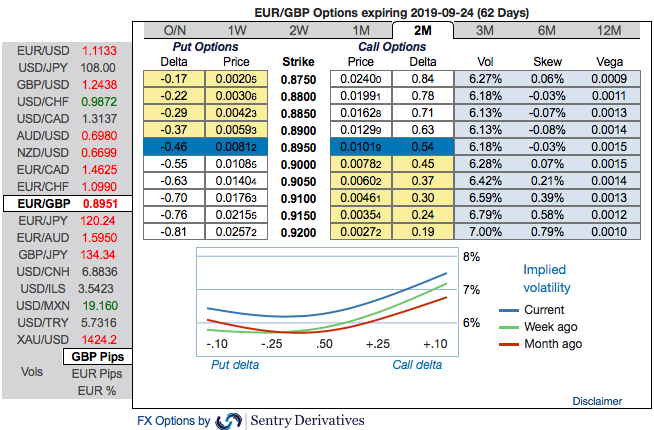

Bullish neutral risk reversals of EURGBP have been observed to the broader bullish risk outlook in the FX OTC markets, this is interpreted as the hedgers are still keen on bullish risks but with mild downside risk sentiment in the near-term, while the pair displays 6.49-6.82% of IVs.

While positively skewed IVs of 2m EURGBP options have been balanced on either side, bids for both OTM calls and OTM puts. This is conducive for options holders of both OTM call and put options.

While EURGBP risk reversals of the existing bullish setup remain intact, even if you see any abrupt negative risk reversal numbers, it should not be perceived as the bearish scenario changer. Instead, below options strategy could be deployed amid such topsy-turvy outlook.

3-way options straddle versus ITM call recommendations seem to be the most suitable strategy for EURGBP contemplating some OTC sentiments and geopolitical aspects.

Options Strategy: The strategy comprises of at the money +0.51 delta call and at the money -0.49 delta put options of 2m tenors, simultaneously, short (1%) ITM puts of 1w tenors. The strategy could be executed at net debit but with a reduced trading cost.

Hence, on hedging as well as trading grounds, initiate above positions with a view of arresting potential FX risks on either side but slightly favoring short-term bearish risks. Courtesy: Sentrix and Saxo

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch