Interim bearish swings in consolidation phase are coupled with both leading and lagging oscillators.

Amid the mild downswings for the day, bulls are on the verge of hitting 4-weeks highs.

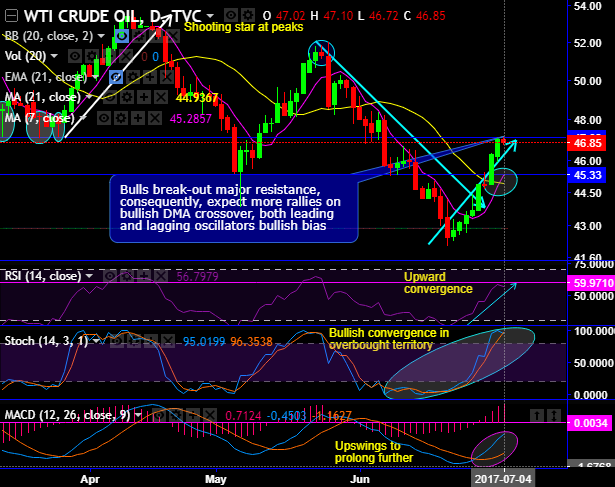

Bulls manage to break-out major resistances at 45.33 levels, consequently, expect more rallies on bullish DMA crossover, both leading and lagging oscillators seem to be bullish bias.

And in earlier months as stated in our previous post, WTI crude price has been tumbling through ascending triangle support (on monthly chart) showing momentum in price declines after the formation of streaks of bearish candles.

Bulls have been spiking consistently higher above DMAs despite today’s mild bearish swings, for now more rallies likely on bullish DMA crossover.

RSI evidences the upward convergence to the price spikes. While stochastic curves have been indecisive.

To substantiate this bullish stance, monthly MACD on both timeframes signals upswings to extend further.

But on the flip side, it’s been in the consolidation phase from last more than a year or so, but you could very well figure out the breach below triangle support, subsequently, downswings are evidenced.

On a speculative basis, we encourage short-term long build ups via WTI crude of near-month futures for targets of $50.48 levels with strict stop loss of $44.94 levels, thereby, the trade carries attractive risk reward ratio.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?