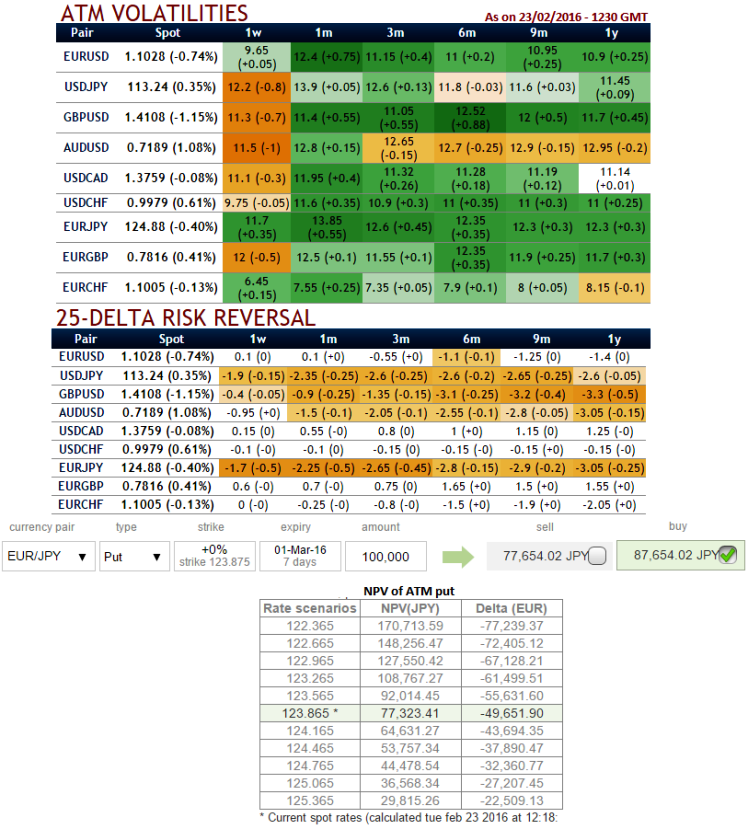

Please be noted as to how the delta risk reversal numbers are getting higher negative values gradually in a long run (flashing at negative -3.05 for 1 year expiries) which is highest among G10 currency space.

ATM implied volatilities of 1Y expiries are also moving in sync with these hedging arrangements. Volatility smiles most frequently show that traders are willing to pay higher implied volatility prices as the strike price grows aggressively out of the money. (IV grows at 13.85% which is the highest among euro crosses).

The euro has started the trading week with losses, as the pair trades at the 1.1060 in the European session. On the release front, German and euro zone manufacturing PMI disappointed at 50.2 by missing estimates at 52.0. In the US, Manufacturing PMI is scheduled for today. Shortly, there is a data release which is the key indicator- German IFO business climate.

Technically, after dropping from last week's 125.751, it has also broken channel support, we expect more dips extending up to 120.403. With the current spot FX is trading at 123.989, it is understood that leading oscillators are signalling bearish momentum is bolstering as we saw that from delta risk reversal table is also moving in line with this indication. Hence, aggressive bears can initiate strategy using ATM puts.

1W At The Money 50% delta puts are trading 13.35% higher than NPV. The broader the strike difference between short and long puts, the fewer puts you need to sell to cover the price of the long puts.

But at the same time, the coverage of long-to-short is going to be more difficult in the event of assignment.

So, the recommendation for now is to add an extra long on put with 1m expiry to the debit put spreads or a fresh back spreads (2:1) can be built in capitalizing on overpriced ATM puts on short side with 1w expiries.

Since the option you sell will always be lower on the skew curve it means you are getting a better deal on what you are selling compared to what you are buying.

It makes this strategy a good one if the skew is running a little hot but EURJPY hasn't rolled over that much. While, for risk averse we take advantage of the spike in EUR/JPY skew via an appearing put spread structure. Namely, going long in debit put spread with a RKI barrier set on the option with the lowest strike.

As the yen calls are very expensive, the risk reversal of euro/yen is very negative (the 3M expiries moved to -2.65 from -1.7 1W expiries). This configuration increases the probability of hitting a downside barrier, making the short RKI put almost as expensive as a vanilla put.

So, go long in EUR/JPY 3M put strike 125, simultaneously, Short EUR/JPY 1M put strike 120, reverse knock-in 120.

FxWirePro: Buy EUR/JPY risk reversals, capitalize on upswings via debit spreads for hedging as IVs spiking higher – PRBS for aggressive bears

Tuesday, February 23, 2016 6:53 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?