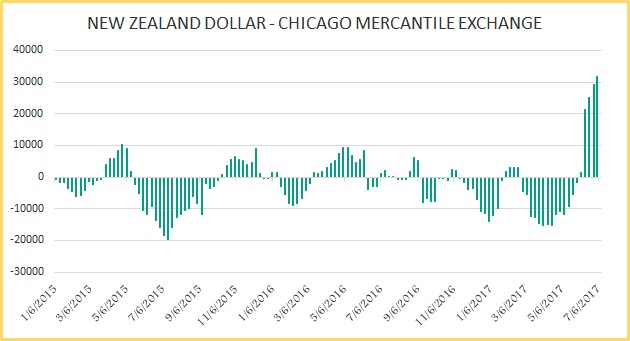

As the speculative positions rise on the Buying side, as can be seen from the Chart 1, we at FxWirePro, expect the New Zealand dollar to move sharply higher against the US dollar, just like what has been happening in the case of the Australian dollar. The Australian dollar has decisively broken above its range that has been in place since 2015.

While the price of oil has declined after a sharp rise last year, the similar can’t be said for other commodities namely metal and soft commodities. The Australian dollar is benefiting from a higher commodities prices and we expect the same for the kiwi dollar. In addition to that, economic adjustments to lower commodity prices are over both for the Australian and New Zealand economy and the economic numbers have been quite strong in recent months.

We at FxWirePro, expect the New Zealand dollar, which is currently testing resistance around 0.735 area to rise to 0.825 area with interim targets around 0.75, 0.765, 0.786, and 0.8.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX