Kiwis losing streak has been stronger from last 1 year to hit almost 6 year's lows. On weekly charts, from last April the pair has been tumbling non-stop to evidence the huge loses.

Shooting star like candle is occurred on daily charts and the trend on this chart has still been weaker as the RSI (14) is converging downwards with massive price dips. While %D line is attempting for crossover on slow stochastic at 34 levels.

Overall, the major trend has been downtrend dominated by the bears with clear volume confirmation.

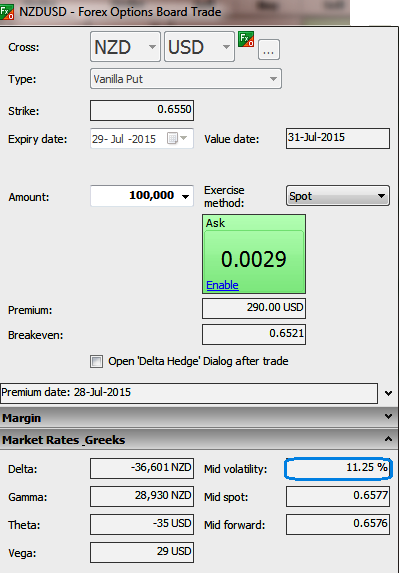

The implied volatility for near month contracts of NZDUSD pair is seen at 11.26%, which is comparatively higher in APAC currency baskets except USDJPY.

We recommend on pure speculation basis buying one touch binary puts in order to extract leverage on extended profitability. By employing At-The-Money binary delta puts one can multiply returns by twice, thrice or even pour returns exponentially. But do remember these are exclusively for speculative basis.

The prime merits of such one touch option are high yields during high volatility plays. Wider spreads indicates lack of liquidity. The spreads for one touch NZD/USD options are constant time and barrier levels. Usually, such binary options for every change in 1 pip the relative change in option price 0.01% or even exponential at high implied volatility times.

FxWirePro: Buy One touch spreads to trade HY vols on NZD/USD’s unstoppable downswings

Friday, July 24, 2015 11:39 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary