Key factors that perhaps explain the recent JPY softness:

1) There might be relatively large JPY-selling flows due to active FDI outflows by Japanese corporates and

2) The portfolio investments by Japanese investors. These activities have been solid for a long time since Abenomics started. As a more recent development,

3) The higher oil prices might have started to weigh on JPY.

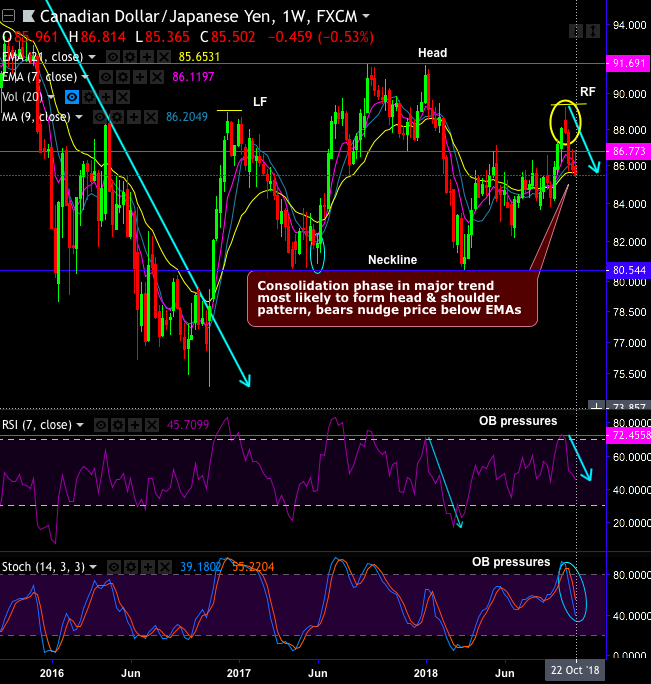

Technical glance:Technically, on a broader perspective, the major downtrend of CADJPY which is in consolidation phase since December 2015 has now been forming head and shoulder chart pattern (refer weekly plotting) which is bearish in nature. However, we cannot afford to disregard the bullish attempts unless it breaches below 83.795 levels where it acts as the strong support.

Options Trading Strategy (CADJPY):

Contemplating above factors, although it is sensed that all chances of Japanese Yen may look superior over Canadian dollar in the near-term future; we advise to hedge the JPY’s depreciation over CAD through below recommendations.

We’ve been firm to hold on this strategy on both trading as well as hedging grounds, unlike spreads, combinations allow adding both calls and puts at a time in our strategy.

Buy 1m at the money delta put option and simultaneously buy 2 lots of at the money call options of similar expiries. It involves buying a number of ATM puts and double the number of calls. The option strap is more of customized version combination and more bullish version of the common straddle.

Huge profits achievable with the strap strategy when the underlying currency exchange rate makes a strong move either upwards or downwards at expiration, with greater gains to be made with a upward move. Hence, any hedger or trader who believes the underlying currency is more likely to spike upside can go for this strategy. Cost of hedging would be Net Premium Paid + brokerage/commission paid.

Currency Strength Index:

FxWirePro's hourly CAD spot index is inching towards -17 levels (which is mildly bearish), while hourly JPY spot index was at 169 (bullish) while articulating (at 08:52 GMT). For more details on the index, please refer below weblink:

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures