Near-term CAD risks skewed positive but medium-term uncertainties linger. Although the past few weeks have brought little new to resolve medium-term uncertainties, recent relative outperformance is likely due to positive oil price exposure, and less stretched price and positioning compared to peers. Much of the swings in CAD this year (vs the USD as well as other peers) have been driven by oscillations of expectations around some major aspects of the Canadian macro backdrop.

Medium-term perspectives: The BoJ tightening may be a long way off, but that won’t stop markets from starting to price it in, supporting the yen and depressing CADJPY below 82.500 by Q3-end.

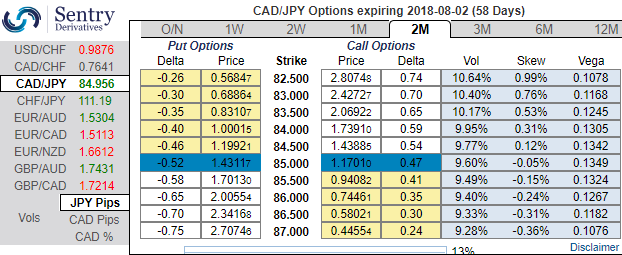

This is substantiated by the positively skewed IVs of 2m tenors, if you refer above nutshell, the skewness for the bids are for OTM puts upto 82.500 levels. Hence, hedgers’ sentiments are still mounting for the bearish risks.

We bought a 2m 87.100 CADJPY put, Reverse Knock-outs 83.100 for 14bp in mid-April while squaring off CADJPY positions, simultaneously, the short hedges were also suggested.

While simultaneously, Initiate shorts in futures contracts of mid-month tenors with a view to arresting further potential slumps.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly CAD spot index is displaying shy above -61 levels (bearish), while hourly JPY spot index was at -79 (bearish) while articulating (at 07:40 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms