The fifth round of Brexit talks starts this week, with fading hopes that there will be “sufficient progress” on separation issues in time for the EU leaders’ meeting later this month.

The pound has been under pressure over the past week, as domestic political uncertainties increased following PM Theresa May’s speech at the party conference.

Cable has witnessed consolidation phase since October 2016 from the lows of 1.2946 levels to the recent highs of 1.3658 levels.

While implied volatilities still skewed to the downside: Please glance through the nutshell evidencing IVs of 2m tenors that signifies the hedgers’ interests of OTM put strikes amid major consolidation phase of GBPUSD.

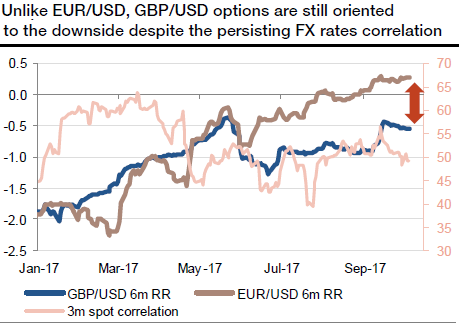

Unlike EURUSD options, cable options are still pricing more implied volatility in the event of a lower currency (refer above graph). The risk reversal curve remains fully skewed to the downside, especially for longer maturities. These diverging expectations are especially striking in a context whereby there is a strong correlation between EURUSD and GBPUSD.

GBP OTC hedging sentiments are intensifying due to the above Brexit negotiations. Is this the beginning of the final phase bearish trend of the British currency? Not yet, but the risks are rising.

Considering above OTC market reasoning and fundamental factors we think upside risks are on the cards, as result we reckon deploying ATM call option with delta being at around +0.51 in hedging strategies are worthwhile.

We fundamentally view asymmetric odds in favor of the topside case, and this highlights the current cheapness of GBPUSD OTM calls.

The execution: Buy GBPUSD 6m/2m/1m bullish seagull strikes 1.27/1.38/1.34 (Spot ref: 1.3113).

This structure has almost no theta between the current spot and the 1.40 region during the four first months. As it is a very low theta means almost no convexity, it, therefore, behaves like a spot trade during this period in this region.

The payoff, however, provides protection against a spot spiking above 1.27.

Risks: Unlimited above 1.38, the structure involves a 2m/1m OTM short call strikes. So investors face unlimited upside risk if GBPUSD trades above that level in 2m months.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One