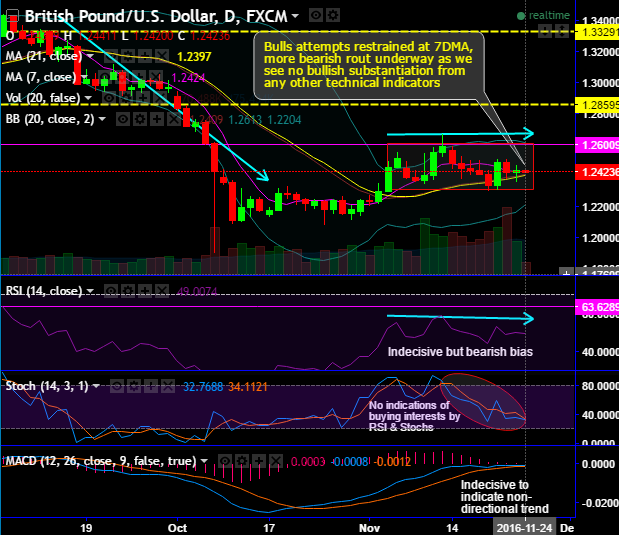

The bulls’ attempts are restrained at 7DMA, more bearish rout underway as we see no bullish substantiation from any other technical indicators.

As a result, the interim bulls drift in sideways, major downtrend still remains intact – Boundary binaries best bids for speculation.

As the US is on holiday (Thanksgiving Day), after the bulls attempts of last two-three weeks, short term trend is now going in sideways (see weekly chart).

As and when you see price jump, bears resume and have been attempting to slide again below 7DMA from the last couple of days on daily charts, the current prices are now stuck in a range of 1.26 and 1.2295 levels.

It is universally known the intensity of the bearish trend of GBPUSD that it tumbled more than 25% in just 2 and odd years.

But RSI & Stoch are Indecisive but bearish bias but indicative of further dips on monthly charts.

Slow stochastic on the other hand noises with the attempts of %D line cross over near oversold region on weekly terms, which means that it alarms bears trying to take over the tight rallies.

Over the medium term, we are seeing the copy-cat range process of the summer range we have been looking for. This has actually become a range within that range, with 1.2300 – 1.2510 the inner range, while 1.2080 – 1.2675 is the current outer range. 1.28-1.30 is major resistance for us above there. The cross is the main driver at this stage.

Long term, we see a greater risk of another downside test, but that should complete the bear cycle we have been in from the 2007 highs at 2.1160. A major base is then expected to develop for an ultra-long term move towards 1.55-1.70 region.

While the current prices on this plotting are well below EMAs.

Monthly MACD’s bearish crossover continued to move below zero level which is bearish region.

Hence, contemplating above technical reasoning, we would still foresee further GBP weakness in medium terms.

Trade tips:

On intraday speculation purpose, contemplating above technical reasoning, we could foresee equal chances for both bears and bulls with 7DMA as strong support with slight bullish bias.

Consequently, the double touch option is useful for traders who believe the price of an underlying asset would undergo a large price movement, but who are unsure of the direction.

A trader can use a double touch option with barriers of about 100 pips between 1.2490 and 1.2390 to capitalize on this outlook.

Some traders view this type of exotic option as being like a straddle position since the trader stands to benefit on a calculated price movement up or down in both scenarios.