Bounce in realised volatility is most likely upon event risks as stated in our recent write up volatility regimes.

Please go through below link for more reading on EURUSD IVs:

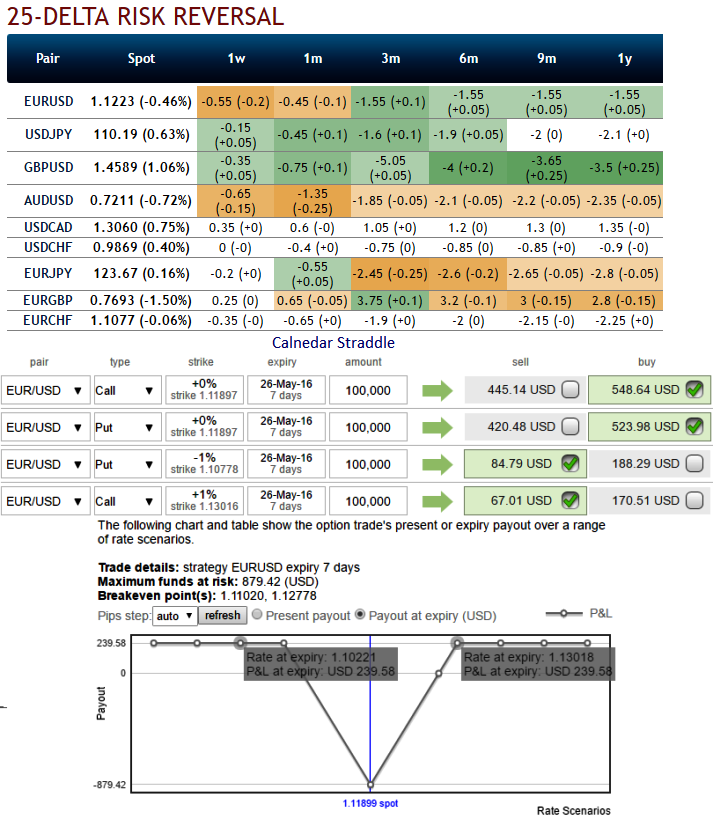

Risk reversals also divulge the more activities in FX OTC markets with positive tickers especially during in 3m tenors which would substantiate IV shifts that is stated in above write up.

Ever since we first saw a rise in the hawkish comments on the part of FOMC members from the start of the month, the US currency has been appreciating by approx. 2.8% against the other G10 currencies (adjusted by risk-off effects) as well as IVs in this dollar crosses.

At spot ref: 1.1187, go short in 2W (1%) out of the money calls + short in 2W (1%) out of the money put options with lower positive thetas or closer zero.

Simultaneously, go long in 2M at the money with 50% delta and long in at the money put option with same tenor and 50% deltas.

Maximum gain for the strategy is earned when the EURUSD is trading at the strike price of the options sold on expiration of the near term straddle.

At this price, both the written options expire worthless while the longer term straddle being held will suffer only a small loss due to time decay. Thereafter, underlying spot FX has to show more move on either direction.

The maximum profit is limited to the extent of only on or before expiry of the near term straddle as the options trader has the option of holding on to the longer term straddle to switch to the long straddle strategy which has unlimited profit potential.

Pease be noted that the tenors shown in the diagram are for demonstration purpose only, use accurate tenor as stated above.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis