Technical Glimpse:

The pair has been tepid but slightly bearish bias from the last couple of trading sessions (see intraday charts).

After the pair facing the stiff resistance at 0.9823 levels, it’s been oscillating between 0.9823 and 0.9775 from last 3 days, but it is currently hanging over supports at 0.9775 levels.

A decisive break-out on either side determines the next trading direction; break-out above may expose toward upside potential up to 0.9866 levels and break-out below would take it to 0.9715 levels in near terms.

OTC Outlook:

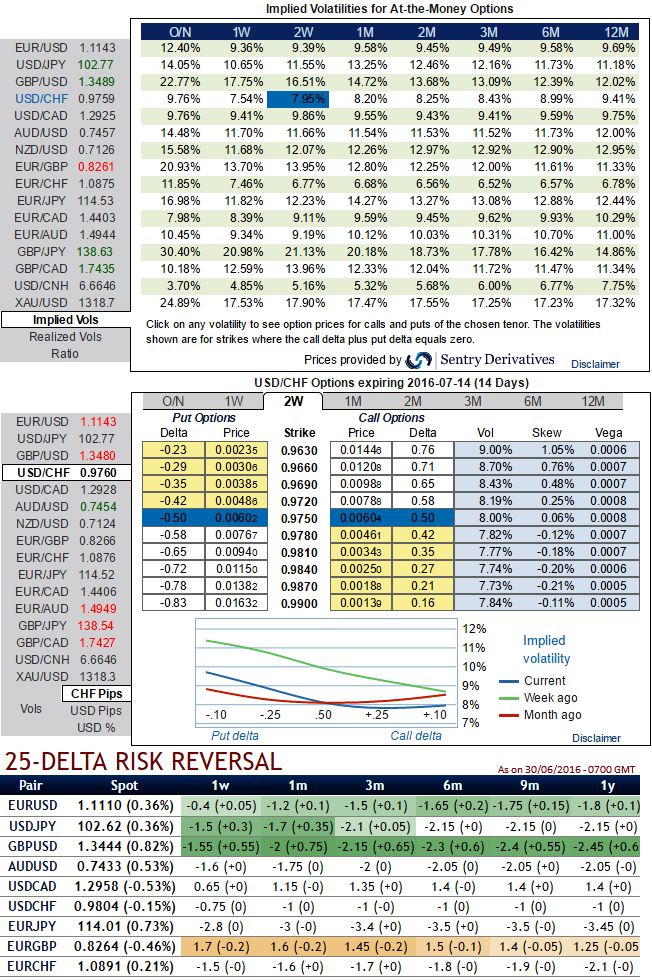

1w implied volatilities of this pair are noticeably shrinking away, slipped below 8% (to be precise 7.7% for 1w expiries and 7.98% for 2w expiries).

While, risk reversals have also been in sync with IVs and spot FX movements as stated above in technical lines, these numbers also have been bearish-neutral for next 1 month or so.

25-delta risk reversals evidence the disparity in volatility, and price, between puts and calls on the most liquid out of the money (OTM) options quoted on the OTC market.

FX Option Trading Tips:

Contemplating on technicals, IVs, and risk reversals we USDCHF to continue to go in a narrow range, as a result, we could foresee the range bounded trading opportunity in the prevailing range of 1.0096 and 0.9635.

Thus, smart approach USDCHF is that to deal with this lower implied volatility times, we eye on collecting credits or short for premiums, and hope for a contraction in volatility which OTC market has already signalling.

Both on speculative and hedging basis call ratio spreads are advocated.

The ratio spread is a neutral strategy in options trading that involves buying a number of ITM options and simultaneously shorting more numbers of OTM options of the same underlying FX and expiration.

With these higher proportionate bearish positions, one can achieve the limited returns but an unlimited risk as the underlying spot keeps flying

These positions are to be executed when the options trader ponders over that the underlying spot would experience little volatility in the near term.

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays