Thin trade given local holidays. AUDUSD seems to be resilient to equity wobbles so 0.7130 levels should continue to hold, modest upside bias.

The medium-term perspectives: The northern summer’s risk rally and USD rout extended to AUDUSD 0.74 on 1 Sep. Upbeat equities and commodity price gains including iron ore, copper and gold reinforced the positive A$ mood.

Positioning was, therefore, likely vulnerable to a reversal from any number of catalysts in a world still struggling with Covid-19 pandemic.

While the RBA’s more dovish rhetoric adds weight to the Aussie dollar, with Westpac now calling for a cash rate cut to 0.1% in November. But the RBA is still not attracted to negative rates and Australia’s historically large trade surpluses provide some insulation.

Hence, the base case of a weaker USD over Q4 argues for AUDUSD to drag its minor uptrend in the short-run. While a correction to 0.68-0.69 also seems conceivable.

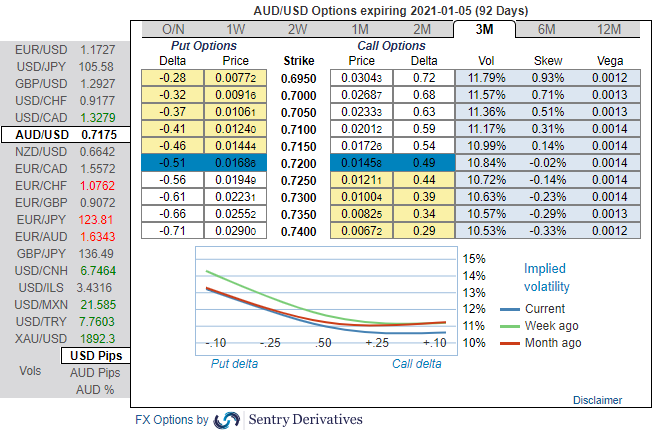

OTC Outlook of AUDUSD and Options Strategic Framework:

The positively skewed IVs of 3m tenors are also in line with the above predictions, they still signify the hedgers’ interests to bid OTM put strikes up to 0.69 levels (refer 1st chart).

Please also be noted that we see fresh bids for current bearish risk reversals (RRs) setup across all the longer tenors are also in sync with the bearish scenarios (refer 2nd chart).

In a nutshell, AUD OTC hedgers’ sentiments substantiate that their risk mitigating activities for the further downside potential has been clear.

Accordingly, diagonal put spreads are advocated to mitigate the downside risks with a reduced cost of trading.

The combination of AUDUSD’s short-term potential to hit 0.7350 and fails from there onwards several times amid lower IVs is luring for the OTM put options writers. While the medium-term perspective is attractive for bearish hedges via ITM puts.

The execution of options strategy: At spot reference: 0.7176 levels, short 2w (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options.

We keep reiterating that the deep in the money put option with a very strong delta will move in tandem with the underlying. Courtesy: Sentry, Westpac and Saxobank

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan