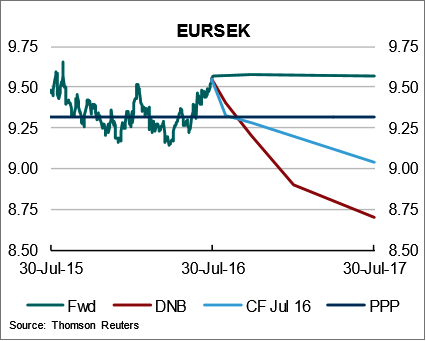

EURSEK has continued higher over the last month, trading a shy below 9.60, which is the highest level seen since last autumn.

The growth in Sweden is solid and inflation has risen. Despite the positive trend, the Riksbank is still worried about the inflation outlook. It is, in particular watching SEK developments, as a sharp appreciation may risk the inflation upswing.

While data still strong and capacity utilization is still higher than normal, data show a loss of momentum. Growth in Q2 disappointed.

Sweden's central bank left its benchmark repo rate unchanged at -0.50 pct on July 6th like other central banks and said it was ready to make monetary policy more expansionary if the inflation prospects deteriorate. However, the interest rate path was lowered as a result of more expansionary monetary policy in other countries.

The 3 months interest differential (SEK-EUR) has fallen 10bps last month. SEK 2017 FRAS has fallen 9-16 bps since June 24th, while similar EUR FRAs are up 2-3 bps.

The Riksbank has signalled that it is prepared to make monetary policy more expansive if necessary and the CB governor has been given powers to intervene. - As inflation picks up further, Riksbanken will gradually become more relaxed about the value of the SEK and to a larger extent again emphasize their financial stability concerns.

Our forecasts are 9.40, 9.20 and 8.70 in 1, 3 and 12 months. Hence, importers and exporters can prefer flexible forwards for their hedging portfolios. The suggested hedge is against NOK and based on FX market forecasts on a 6-month horizon.

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?