We begin stating “capitalize on interim GBP/JPY rallies to deploy shorts in PRBS for hedging on mixed bag of economic numbers in UK and Japan”.

Macro views & schedules:

We continue to maintain our bearish stances as the ongoing downtrend to prevail further ahead of today’s economic numbers such as BoE’s inflation report, PPI and preliminary GDP QoQ.

The recent manufacturing, construction & service PMIs of UK were quite disappointing, whereas Japanese manufacturing PMI was able to produce upbeat number at 48.2 versus forecasts at 48.0 and previous numbers at 48.0.

On the flip side, last week’s Japanese monetary policy minutes upholds their decisions as BoJ kept its pledge to increase the monetary base at an annual pace of about 80 trillion yen at its April 2016 meeting. Policymakers also decided to leave unchanged a -0.1% interest rate and said they will adopt a JPY300 billion loan-supplying program aimed at assisting banks operating in areas hit by earthquakes. While their machinery orders have again reduced from previous -21.2% to the current -26.4%.

The BoJ’s negative rate was probably the right decision, as without the move JPY could be much stronger.

Evidently, we’ve seen almost more than 15% drop in USDJPY in last 9 months, and more than 18.5% drop in EURJPY in 17 months, while GBPJPY slumps over 20% in just 11 months.

Technical Watch:

Current price pattern whipsaws on 21DMA & at pivot levels of 156.853. We don’t think the prevailing price bounces sustain major resistance to reach even major resistance at 161.702 and 162.702 levels.

On monthly plotting, the downtrend has already shown more than 50% Fibonacci retracements, so any minor spikes should not deemed as a reversals, instead use those rallies to deploy long term shorts.

GBP/JPY OTC FX Observation:

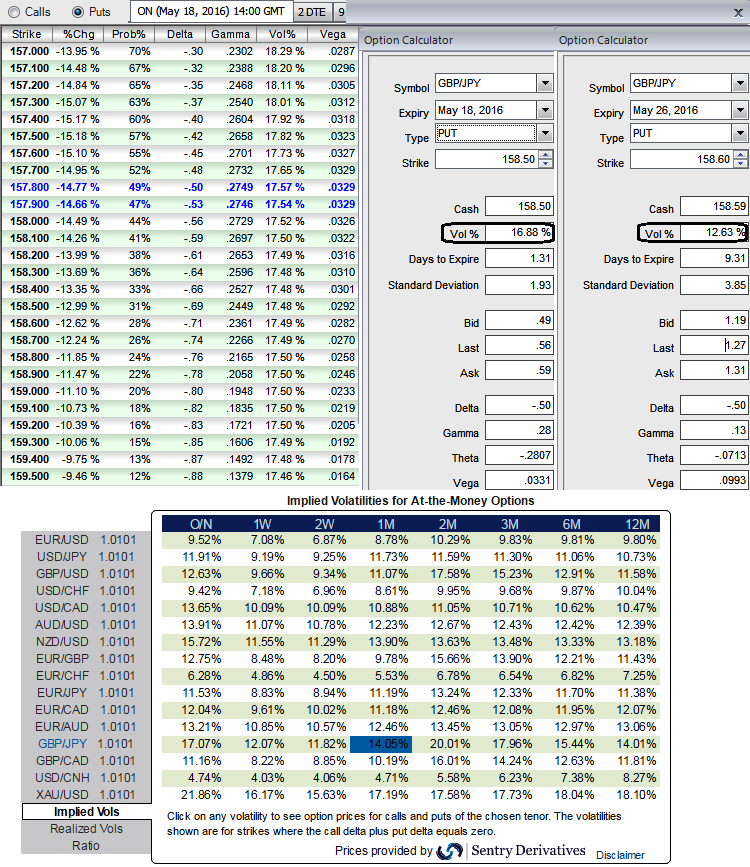

Please have a glance on implied volatilities of ATM puts, the current IVs of this pair is at 17%.

2W to 1M expiries are acting crazily in OTC markets, 11.82% and 14.05% respectively.

Gamma on OTM strikes moving with a rapid speed, but %change in option price is ticking negative figures as the pair evidencing upswings for the day. You can also observe IVs of 1W expiries have reduced a bit, thus this could be interpreted as the right time and right opportunity to deploy shorts in Put Ratio Back Spreads used as a hedging strategy.

What is weighing on the pound's slumps is that, the expectations on BoE’s unlikely changes, above all lingering Brexit probabilities add an extra pressure on sterling's depreciation. But IVs of 2 months tenor will pick up gradually during Brexit announcements.

Hedging Strategy:

So, on hedging grounds initiate longs on 2 lots of 1M At-The-Money -0.49 delta puts that would function effectively in considerably higher IV times (see sensitivity table for higher probabilities and stabilized Vega growth). Simultaneously, deploy shorts side of 1 lot of 1M (0.5%) ITM put option. The net delta should be around 44% and the positions could be entered with reduced debit.

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand