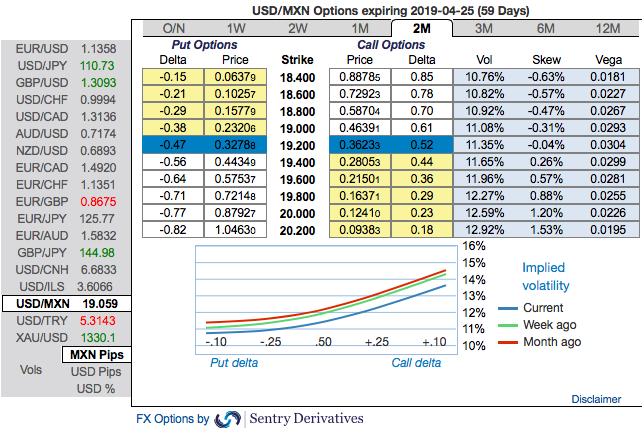

During February trading sessions, Mexican currency (MXN) has traded more resiliently than anticipated, while implied vols have remained close to 2019 lows with positively skewed IVs of 2m tenors are indicating upside risks of USDMXN (refer 1st nutshell). Yet MXN seems to trade rich to fundamentals according to our BEER valuation framework (refer 1st chart) and additional negatives in recent weeks suggests it may be under-pricing some risks.

CFTC positioning data for IMM contracts remains lagged due to the Government shutdown, but show that positions have increased in January.

Specifically, this seems to have happened on the back of real-money investors, rather than hedge funds, according to the same CFTC data (refer 2nd chart), which we hypothesize is due to MXN’s high real rates profile.

In conclusion, we reckon circumstances are such that Mexican peso is more likely to sell off than rally in the near term.

For now, more chances of a selloff than a rally and we continue to prefer positioning via MXN puts rather than in cash to limit the negative carry, and utilize low-risk reversals and implied vols to potentially cheapen trading structures. Courtesy: Sentrix & JPM

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards -78 levels (which is bearish), while articulating (at 13:01 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields