In this write up we run you through writing exorbitant calls in collar spreads for cautious bears.

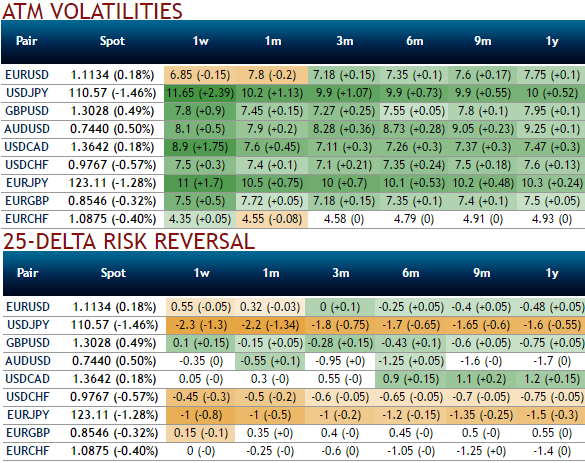

Before that let’s have a glance through the neutral IVs in USDCAD that are creeping up a tad below 7-7.5% across all tenors, the tepid implied volatilities of ATM contracts across all tenors are favorable for option writers.

Please be noted that the ATM Calls of 1w tenor are priced in above 13.7%, whereas IVs are trading just a tad below 9%. Hence, it is deemed as a disparity between option pricing and IVs.

While the risk reversals, for now, have been neutral from 1w-3m tenors, while long-term hedging sentiments have been bidding for upside risks.

Fading towards 7% and below 7.5% for 1-6m tenors, the tepid IVs among G10 FX space despite the fact that Fed’s hiking season is lined up. This appears to be conducive for writers of such exorbitant call options.

USDCAD can be seen below 1.28 driven by:

1) BoC indicates the intention to normalize rates due to an improved global outlook.

2) Global demand pushes oil prices well above $60 and Canadian oil investment picks back up materially.

Please also be noted that the options with a higher IV cost more which is why in this case OTM puts have been preferred over ATM instruments. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favor. If IV increases and you are holding an option, this is good.

On the flip side, when you write an option, the seller wants IV to remain lower level or to shrink so the premium also fades away.

Hence, if any OTM calls are overpriced as stated above, writing such calls are recommended in tepid IVs.

Considering above OTC market reasoning, amid prevailing uptrend we think downside risks can also not to be disregarded in the long term, as result we reckon deploying shorts in such exorbitant call options while initiating longs in ATM puts in our hedging strategies that seem worthwhile under the scenario of the underlying spot FX keeps dipping abruptly driven higher oil prices.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch