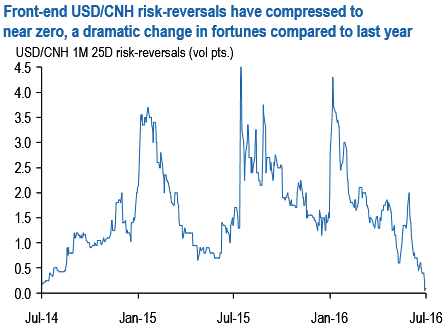

The front-end CNH risk-reversals have shrunk to near zero (see chart) as the PBoC's tight FX management has smashed realized volatility.

CNH vol skews started softening in mid-Q1 when Chinese authorities instituted capital controls to curb capital outflows and have been on a steadily declining trend since alongside a general risk premium compression in China-linked assets.

China risk-reversals in free fall front-end CNH risk-reversals compressed to almost zero this week (see above chart), a rare occurrence in the EM FX world and a dramatic change of fortunes for a currency that was supposed to be spiralling out of control and into a 1990s style crisis only a few months ago.

The move picked up pace this week with 1M 25D riskies falling to 0.05 vols (-0.30 from intra-week highs), effectively signalling symmetric volatility risks in both RMB rallies and sell-offs over the next month.

The optics of nearly flat risk reversals is jarring given the long history of disruptive EM currency weakness that usually commands a healthy premia for USD calls over USD puts, and the more recent macro-narrative of declining growth, unsustainable leverage and capital flight around China that ought to have been priced into options via fatter right tail probabilities (i.e. higher USD call/CNH put prices).

Unsurprisingly, anecdotal accounts indicated investor interest in snapping up zero price CNH riskies purely on price grounds, even if catalysts for a volatile sell-off over the next month are not obvious.

Stay short 6M vol; USD puts/CNH calls are better shorts than ATMs to monetize RMB stasis given the skew set-up.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025