Before proceeding to the core part of this write-up, let’s just quickly glance through the prevailing situation in China. The new clusters has emerged in North Eastern China bordering with Russia after more returnees from Russia were tested positive for covid-19. The number of patients in severe situation in Hubei fell to 75. Most of Chinese medical resources have been freed up from covid-19. One good news last week is that China is also moving towards mass testing model. Premier Li Keqiang ordered last week that China should increase PCR test and antibody test to identify infected persons as soon as possible.

Today's focus for Asia is China's March trade data, which came in much better than expected. Import growth, in particular, turned positive, implying that manufacturing sector should have outperformed after the operation resumption. However, combined the first three months of 2020, China still registered a very weak trade performance, with total trade falling more than 10% on a year-on-year basis, while there might have emerged some "catch up" effects in March. CNY strengthened somewhat this morning as headline trade data surprised on the upside.

On a related note, data compiled by South Korean trade ministry suggest that shipments to China dropped by a double-digit pace in the first 10 days of April. Media also reported that the many Chinese companies are facing plunging export orders recently amid the lockdown in the US and Europe.

More importantly, Chinese FX reserves declined by USD46bn in March, the biggest drop since December 2016. However, the authorities explained that this is largely due to the valuation effects as stock market crashed in March and dollar strengthened (which would reduce the dollar value of non-dollar reserves). Recent data provided by Chinese foreign exchange regulators suggest that corporates and individuals have turned to net selling dollar positions (i.e. long CNY) in the first two months of 2020.

Nevertheless, it remains questionable whether this trend could sustain. In the FX market, CNY simply ignored the seemingly negative headline reserve data, and rallied against the overall risk-on sentiment, with USDCNY below 7.05 mark.

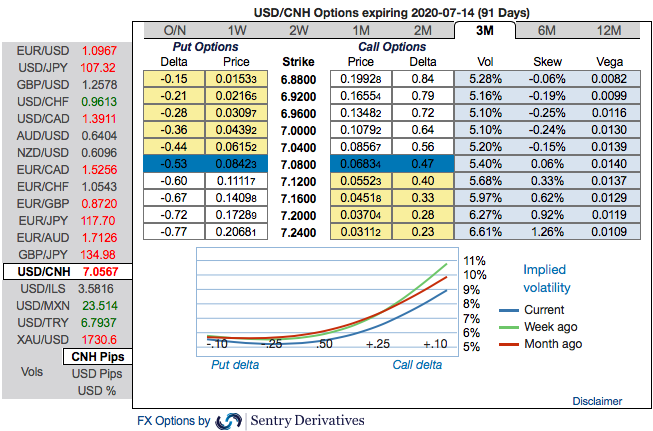

Please be informed that the positively skewed USDCNH IVs of 3m tenors still indicate the upside risks, they are still bids for OTM call strikes up to 7.24 levels.

Hence, at this juncture, we uphold our shorts in CNH on hedging grounds via 3-month (7.00/7.25) debit call spread. If the scenario outlined above unfolds, we will re-assess our stance but at the moment there are no changes to our CNH recommendations. Courtesy: Sentry & Commerzbank

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes