FX analysis has become very difficult as nobody could predict what would happen in the next day morning. All the surprises related to China come through different channels.

First, the China data dump released this morning clearly illustrated the virus damages on the economy, where we see all data freely falling and hitting record lows.

Looking ahead, there would be some sort of data recovery after the economy gradually resumes operations. However, the hope of a V-shaped recovery seems unlikely given the virus is spreading rapidly all across the world.

Secondly, the Chinese central bank held the rates for medium-term lending facility (MLF) unchanged this morning, although the Fed has slashed the rates to almost zero in about two weeks' time. This somehow contrasts the sluggish economic data, which seems to suggest that the Chinese authorities still want to wait to see the full economic picture after the supplies come back. Nonetheless, it again shows the difficulties to understand China's policy framework.

Thirdly, the housing prices remained almost flat in February while the sales volumes at least halved in the month. This again somewhat surprised me but might also suggest that the housing prices are a lagging indicator. All told, we have so many "unknown unknowns", and the USDCNY still hovers above 7 handle, indicating that the investors also find it difficult to find a convincing direction for now.

OTC Outlook & Hedging Strategy:

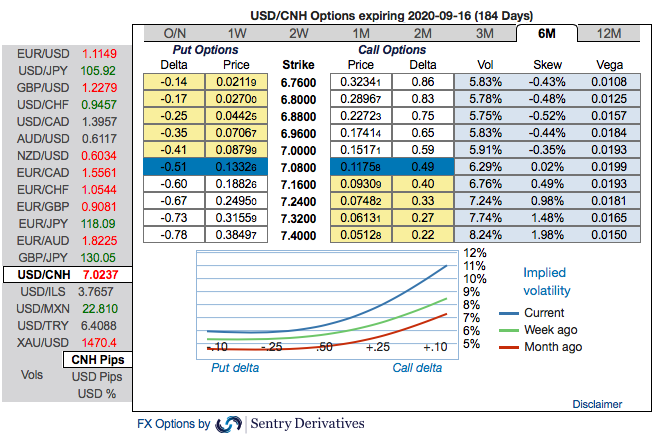

Please be informed that the positively skewed USDCNH IVs of 6m tenors still indicate the upside risks, they are still bids for OTM call strikes up to 7.40 levels.

At this juncture, we uphold our shorts in CNH on hedging grounds via 6-month (7.00/7.40) debit call spread. If the scenario outlined above unfolds, we will re-assess our stance but at the moment there are no changes to our CNH recommendations. Courtesy: Sentry & Commerzbank

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Apple Downgraded by Jefferies Amid Weak iPhone Sales and AI Concerns

Apple Downgraded by Jefferies Amid Weak iPhone Sales and AI Concerns  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Insignia Financial Shares Hit 3-Year High Amid Bain and CC Capital Bidding War

Insignia Financial Shares Hit 3-Year High Amid Bain and CC Capital Bidding War  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Why the Middle East is being left behind by global climate finance plans

Why the Middle East is being left behind by global climate finance plans  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Condemns China's Dominance in Global Shipbuilding and Maritime Sectors

U.S. Condemns China's Dominance in Global Shipbuilding and Maritime Sectors  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios