BoE has recently stood pat at the benchmark UK interest rate at 0.5%. This unchanged rate was no surprise to the forecasts.

BoE's QE in Jan total GBP stays flat at 375 bln GBP vs previous 375 bln GBP.

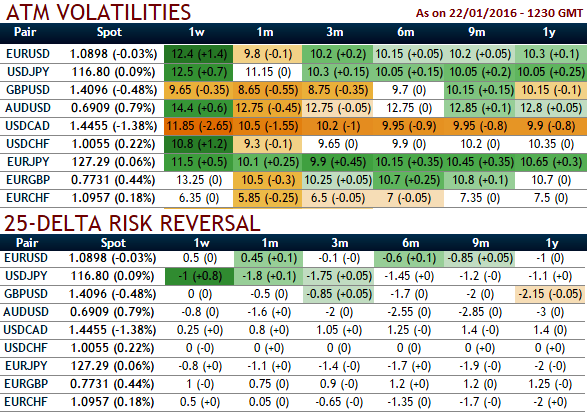

The implied volatility of ATM contracts for near month expiries of this the pair is at around 13.25% for 1W contracts which is second highest among G10 currency space.

While delta risk reversals spiking up progressively with positive numbers signify hedging sentiments are well equipped for upside risks over the period of time. While current IVs of ATM contracts are at higher levels but likely to perceive hover around 10% in long run would divulge pair's gain.

Hence, considering implied volatility and OTC market sentiments we think upside risks are on the cards as result of deploying ATM instruments. Now if you think speculation in potential uptrend in short terms is not possible as delta risk reversal suggested calls have been overpriced then let's look at an example.

At this point of time, if you expect that EURGBP will spike up moderately over the next near future, which is currently at 0.7607 spot FX. You decide to initiate a bull put spread at net credits, buy next month +1% Out of the money -0.5 delta put option. Simultaneously, short 1W (-1%) in the money put with positive theta.

Notice in this instance that the put we bought is out of the money and the put we sold is in the money with an anticipation of EURGBP could rise or remain unchanged, and there onwards any abrupt fall would be taken care by longs in OTM put and your active longs in spot FX would be protected.

Maximum profit: The initial credit received for this trade, less commission costs.

The maximum risk is the difference between the two strike prices, minus the credit you received.

FxWirePro: Combination of HY vols and risk reversal favour EUR/GBP bullish momentum – deploy credit put spreads

Friday, January 22, 2016 8:16 AM UTC

Editor's Picks

- Market Data

Most Popular

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan