The trader can implement this strategy using call options with similar maturities to deal with lower implied volatility. Construct a long condor option spread as follows ideally for the short call spreads to expire worthless. One should use this when expectation the exchange price of the GBPUSD to change very little or within a very tight trading range over the life of the option contracts.

So strategy goes this way, writing an (-1%) In-The-Money call and buying deep striking (-1.5%) In-The-Money vega calls, writing a higher strike (1%) Out-The-Money calls and buying another deep striking (1.5%) Out-Of-The-Money vega call for a net debit. For demonstrated purpose we have used identical expiries but in live scenarios use the longer maturities on longs and shorter maturities on shorts.

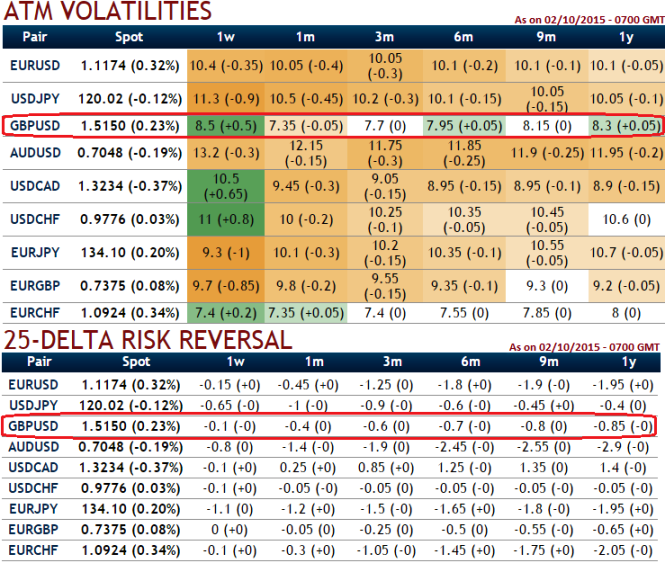

Since the cable's implied volatility is still perceived to be comparatively minimal within next one month time frame from other major G7 pairs (at around 7-8%), so here comes a multiple leg of option strategy for regular traders of this currency cross when there is little IV. A total of 4 legs are involved in the condor options strategy and a net debit is required to establish the position.

Rationale: As there are no significant data releases that could propel GBP side for next week until Thursday except service PMI. On thursaday, BoE's official bank rate is scheduled which we think at 0.5% for more than six years, looks set to remain fixed until well into 2016, according to markets. It could be far longer, and in near future GBPUSD may likely to experience low volatility. You can make out from the nutshell showing IV; GBPUSD is to have the least IV among G7 currency pool.

FxWirePro: Condor spreads best suitable on cable’s lower IV

Friday, October 2, 2015 11:05 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary