Crude oil prices showed a minor pull-back on supply concerns. It hit a high of $72.05 and currently trading around $72.02.

In response, China has just said it was placing its own tariffs on specified American products that come into effect starting February 10. They would include the placement of 15% on importation duty of U.S. coal and liquified natural gas, along with 10% on importation duty on crude oil as well as farm equipment. China has also filed a complaint with the World Trade Organization against the U.S. tariffs and expanded controls on critical minerals. They've added two U.S. companies to their Unreliable Entity List and launched an investigation into Google. China's Foreign Ministry has emphasized that trade wars hurt both countries and called for equal dialogue. The U.S. tariffs impact about $450 billion worth of Chinese goods, and China's tariffs target $15 billion to $20 billion worth of American products.

In February 2025, the U.S. imposed new sanctions targeting Russian and Iranian oil exports to reduce revenue for both countries. These sanctions affect major Russian companies like Gazprom Neft and Surgutneftegas, as well as networks facilitating Iranian oil shipments to China. About 183 oil tankers are now subject to these sanctions, complicating Russia's ability to export oil, which could lead to a reduction of 0.5-1 million barrels per day in the short term. Consequently, Chinese buyers are hesitating to purchase Russian oil while exploring other options. The U.S. aims to disrupt the funding Iran uses for regional activities through these measures and has committed to actively pursue any evasion of the sanctions.

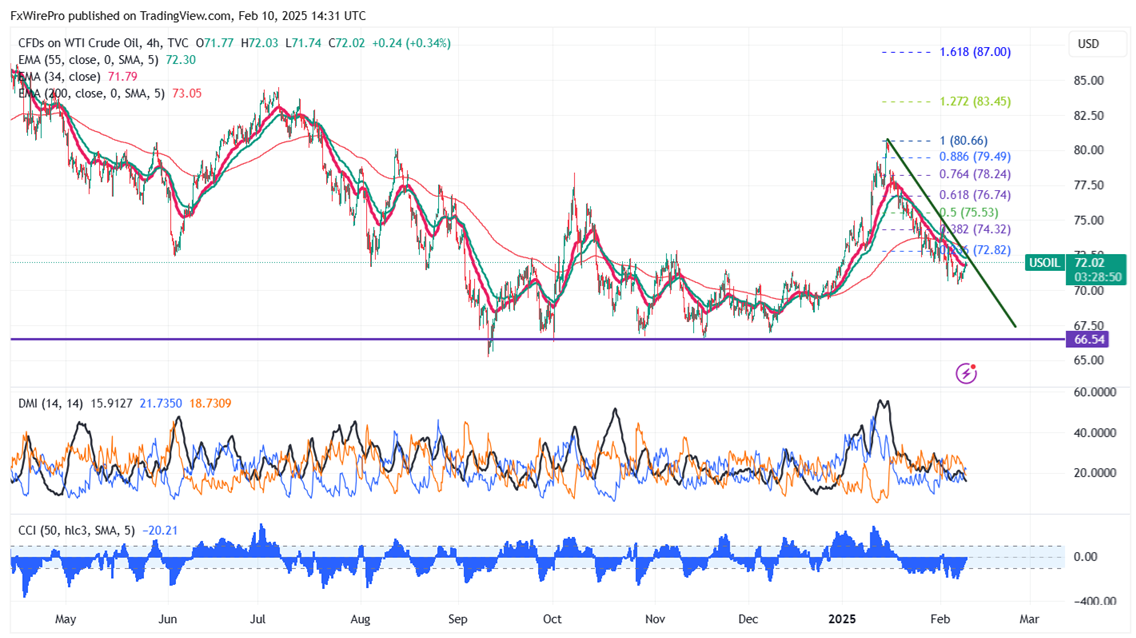

Price Resistance and Support Levels

The near-term resistance is around $72.11; any breach above this level could push prices higher to $72.85/$73.06/$74.32/$75. On the downside, immediate support is at $70 violation below targets $69/$68/$65.50.

It is good to sell on rallies around $70 with a stop-loss around $69 and a target price of $73.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings