Crude oil withstood a wild ride over the past two weeks, first breaking above $65/bbl (Brent) on news of the Forties pipeline outage but collapsing after on increased rhetoric around exit strategy from the current production cut deal, U-turns from Nigeria and Libya in refusing to abide by last month’s agreed output caps, OPEC’s higher shale supply projections for 2018 and weak DOE inventory numbers.

These moves in crude correlate only loosely with moves in petro-FX – indeed, oil and oil currencies have decoupled for a while now –but only serve to increase the marginal volatility of CAD and CAD-crosses at a time when the currency is being buffeted by cross-currents of BoC policy shifts and international trade frictions (NAFTA).

Monetary policy to be more decisive than oil prices. The oil performance has been instrumental in boosting the currency in 2017, even though the long-term picture suggests that the currency has overshot the rebound in oil prices. However, the CAD is on the right track to remain strong: the interest rates factor is taking over from the commodity factor. CAD rates recently climbed above USD rates for the first time since 2014 (refer 3rd chart), and our USD rates projections can realistically drag the USDCAD to 1.20.

The Bank of Canada (BoC) has become extra vigilant again after CAD appreciated comprehensively succeeding two rate hikes. In view of numerous lingering risks (inflation, crude price, NAFTA) the BoC does not want to be overly optimistic. We assume that for the time being the BoC will initially follow the Fed’s rate hike speed so as to prevent strong CAD appreciation against USD. The better growth outlook in Canada, as well as the more stable political environment, will, however, allow gradual CAD appreciation in the future.

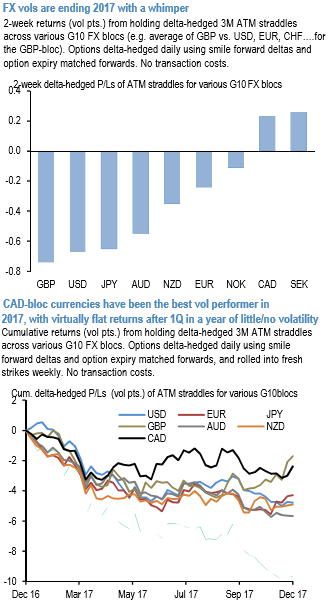

As the 1st chart displays, CAD-crosses have been among the better performing vol blocs in recent times, and the clear outperformer on a relative basis within G10 currencies over the past year with virtually flat returns since the broad vol collapse in 1Q even as others – with the notable exception of GBP – continued to crumble (2nd chart).

Yet CAD implied vols have not re-priced in any meaningful fashion to reflect this delivery: USDCAD 3M ATMs are up only 0.2 vols over the past month, crosses such as EURCAD (+0.5) and CADJPY (-0.2) have not fared a whole lot better. Part of this inertia probably reflects seasonal year-end vol softness, but if this state of affairs persists even after markets return in the New Year when both interest rate and trade talks pick up renewed steam, it should be an opportunity to pick up cheap volatility.

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?