FxWirePro- Crude oil trades higher on Middle East escalation, buy above $72.50

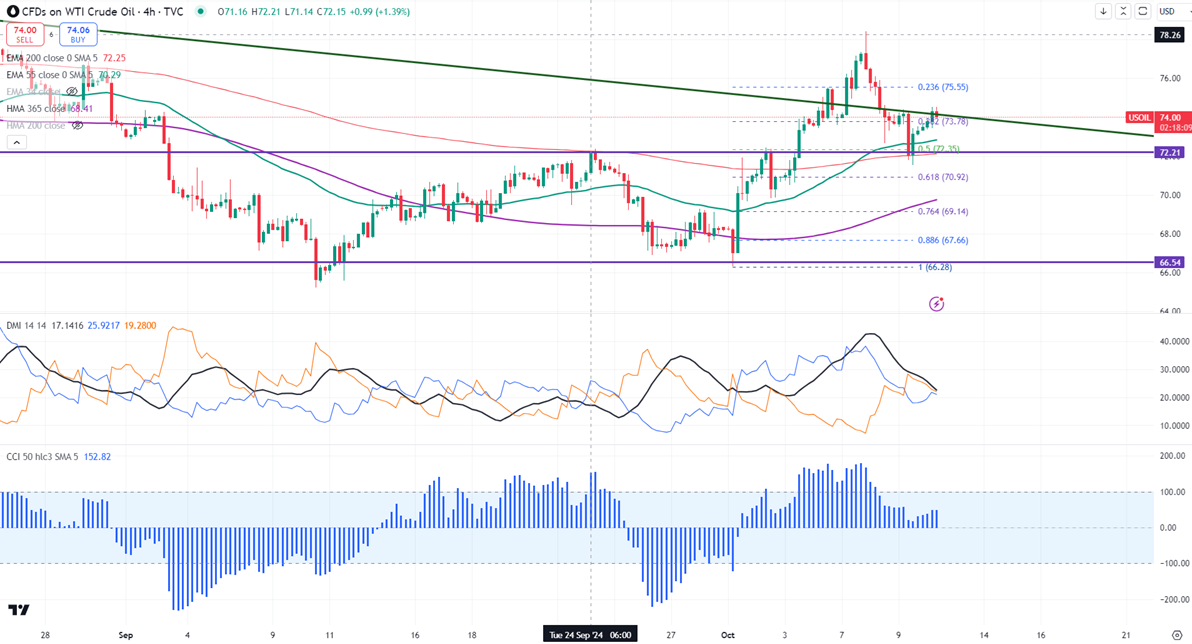

Crude oil recovered more than $1.5 due to short covering. It hit a low of $71.52 yesterday and is currently trading around $74.03.

According to EIA, crude oil inventory EIA cuts demand forecast in 2024 due to weak growth in the US and China.

Markets eye ceasefire talks between Israel and Iran for further movement.

US dollar index - Bullish

US treasury yield- bullish (negative for commodity market).

Major resistance- $74.62. Any breach above will take the commodity to the next level $74.89/$75.50/$75.97. Major trend reversal only above $80.

The near-term support is around $71.50, any violation below targets $70.90/$70/$69.

Indicators (4- hour chart)

ADX- neutral

CCI (50) - Bullish

It is good to sell on rallies around $75 with SL around $76.20 for TP of $70.90.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate