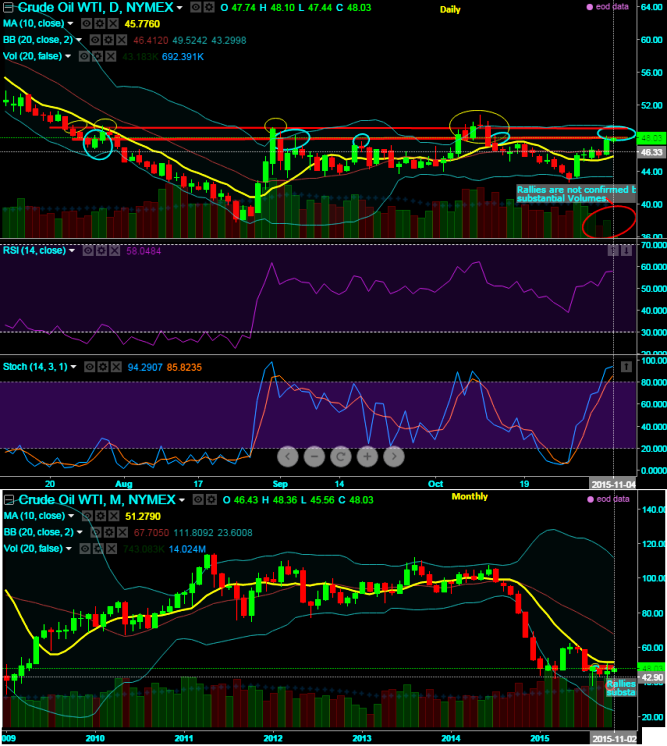

WTI crude is attempting to beach resistance at 48.10 levels which has already tested this level as crucial point of demand and supply several times in the past (see blue colored circled areas).

It may drag up to 49.40 if it manages to break above decisively. For now, we are bearish on this commodity and advisable to sell on every rally.

The selling indications are bolstering as there seems to be a factor called volumes fading away. Hence, we reckon the previous rallies were only due to short coverings and certainly not to be regarded as bullish trend unless it breaks above resistance levels.

RSI is showing bullish convergence to the prices rises (currently RSI 14 trending at 62.1708 while articulating).

While slow stochastic approached overbought territory but there are no convincing hints of %D crossover (currently %D line at 85.8235 & %K line at 92.2907)

We spotted out the series bearish candles like dojis both on daily and monthly charts and spot price is still fallen below moving average curve on monthly charts.

So overall we could foresee 46.50 as a strong support if it fails to hold onto 48.10. It is advisable to short futures at spot levels for immediate targets at 46.50 with stop loss at 48.50, thereby risk reward would be 1:2.

FxWirePro: Crude struggling to break resistance at 48.10 - Short WTI crude for TP at 46.50 with risk rewards 1:2

Wednesday, November 4, 2015 12:59 PM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary