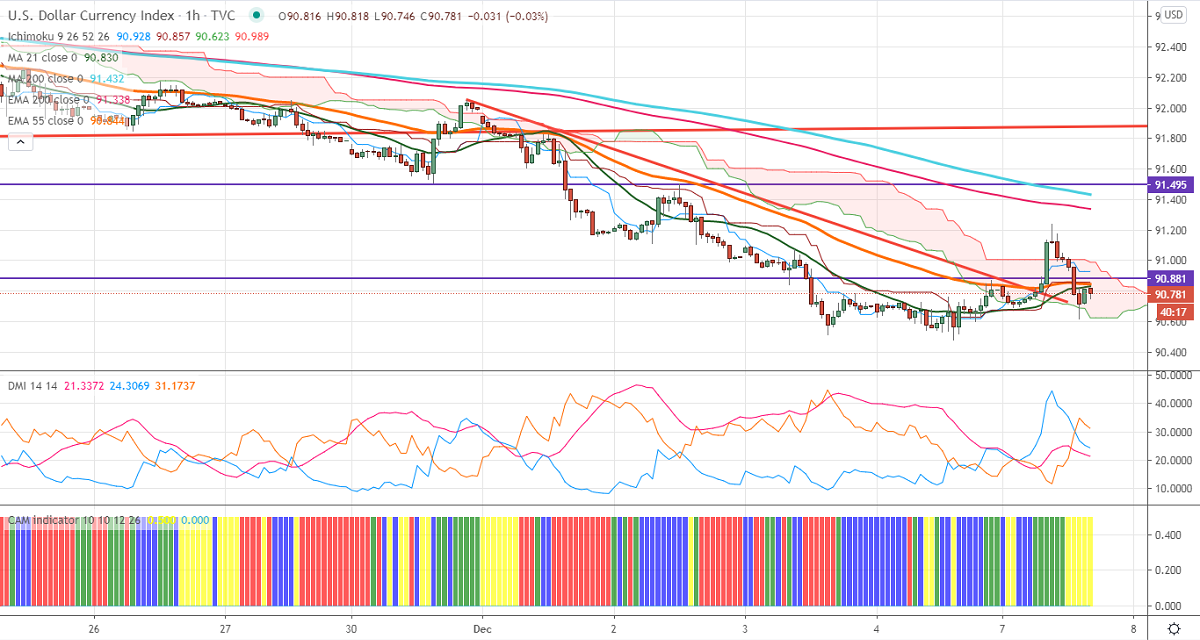

Ichimoku Analysis (1-hour chart)

Tenken-Sen- 90.92

Kijun-Sen- 90.85

US Dollar index has started to decline after a minor recovery till 91.238. Short term trend is still bearish as long as resistance 91.50 holds. The index lost more than 10% in the past 9 months on vaccine optimism and US stimulus hopes. The economy has added 245K jobs in November compared to a forecast of 460K. The unemployment rate dipped to 6.7% from 6.8%. It hits an intraday high of 91.238 and is currently trading around 90.77.

On the higher side, near-term resistance is around 91.50, any convincing violation above targets 92/92.27/92.53. Significant bullishness only if it closes above 93.20.

The index is facing strong support at 90.50,any indicative break below will take the index till 90/89.85.

It is good to sell on rallies around 91.10-20 with SL around 91.50 for the TP of 89.